"The quickest way to acquire self-confidence is to do exactly what you are afraid to do." -Famous last words

A lot of dubious survivorship bias gets built into some inspirational quotes.

I don't mean to discourage people from learning and doing new things—just the opposite. I want for people to learn the fundamentals of new things [most of all] as often as they have the time, energy, resources, and desire. But try not to pay too much for the lessons. In fact, I consider all that [education] to be the primary mission of Rounding the Earth (RTE), which was originally conceived of as a broadly educational project (and will hopefully tend in that direction as global emergencies subside).

If you're not careful trying new things, you'll invite the psycho-technological machinery of Matrix back into your life to pf#*& with your mind. That's when people fade away emotionally and become a tool of the machine.

Consider this article a warning of a general kind. I'm taking a risk that the information herein will be received in the spirit in which it is intended. I am not here to pick a fight with Ed Dowd. In fact, I hope that he will take stock of his surroundings and then find a good way to focus on good work.

Trading is the Wild West

"Markets can remain irrational a lot longer than you and I can remain solvent." -Gary Shilling

In 1998 I was 21 and trading the largest bond account at D.E. Shaw. During my first year in finance, I worked and lived (what living there was outside of work) through the Asian bond crisis, the collapse of the Russian ruble, and the Long Term Capital Management (LTCM) debacle. These are events that collectively tested global finance in historic ways, and yet are a pittance compared to the economic troubles we face today. Banks, hedge funds, and other entities spent considerable time devising new ways to measure counterparty risk that they never imagined necessary.

I know from experience that at least two of the three events I named are likely very different from what you've read about them (if you're starting to get the sense that "constructed narrative" describes most of history, you're getting it), but those are stories for another day. There are also stories that will never be told, but would change the way a lot of people—even the vast majority of people working in finance (due to their own "special problems")—perceive history. I bring this up because I see at work forces on both sides of current debates shaping and writing the history that will be consumed as The Truth(™).

I bring up my professional past mostly because I suspect that most RTE readers are unaware that I made the larger part of my living as a trader. I worked for two of the largest hedge funds (before realizing that I could do much better from my home computer). My finance skills are what allowed for me to work for peanuts for a decade (10% of a public school teacher's wage, give or take) building my two schools without suffering my own economic existential crisis. They are also what allowed for me to drop everything, give up all my clients, stop taking new ones, and focus on pandemic matters.

I often hold back talking about trading, or actively discourage it, because even among brilliant people, very few of them know how to manage the Wild West that is the markets. I wrote most of a book on crypto trading in 2018 after I scorched those markets, but chose not to complete and publish it because I knew that even if I wrote, "DO NOT TRY THIS" in big bold letters at the top of every page, most all of the buyers of the book (who took any risk) would just lose money in the crypto market (a market which is substantially harder than something complex like derivatives trading, which is in turn tougher than managing an Interactive Brokers day trading account).

It was only back in March that I explained the liquidity event known as "Crypto Winter" to Steve Kirsch after I saw him committing to trading algorithms that I knew would fail without a solid understanding of the hype-fail cycle of those markets and its underlying mechanisms (36 months of 6% compounding returns is not even enough to offset a 90% loss during crypto Winter). Of course, Forbes would be a few weeks too late on that warning. Yawn. This was a comment from a Bitcoin education circle I created many moons ago.

Fortunately, out of a three-digit number of people, I suspect that was an entirely isolated hard lesson learned, and one learned even after I pushed those who talked trading too much out of the circle and into their own chat channel. I suspect that I saved those whom I've advised a few million dollars so far over the past 19ish months by discouraging action in the alt coin markets outside of the inevitable FinTech bubble rise (for those few who are savvy enough to ride the wave of the "obvious" Big New Thing and then quickly exit while the bubble is full). We desperately need wealth pools in the rebuilding we have ahead of us, so "playing in the casino" is ill-advised. If you need an investment at this moment, and you're unsure where to park a few hundred dollars ("not real estate capital"), consider growing a garden or building a chicken coop. What I'm saying is that as a markets expert educating people about markets, first do no harm. A doctor wouldn't want to tell a patient that hydroxychloroquine suppresses viral reproduction, but fail to warn them there is a goldilocks zone and a lethal dose curve.

Trading is the Wild West. It's wrong to tell people about hip firing and then send them out into the O.K. Corral to disarm some Cowboys at Tombstone.

Who is Edward Dowd?

Edward Dowd is a former Blackrock executive. That is to say that he worked for the world's largest [known] private (and somewhat shadowy) financial organization which owns substantial portions of the pharmaceutical and media industries. For this reason, many expert typists on the internet speculated that he was "controlled opposition" when he appeared on the scene in January. In particular, many market professionals felt that he was steering sheep to the wolves, but we'll get to why that might be.

Personally, I think that if there is controlled opposition in this story (and I do think there is some of that in "the resistance"), that it's not Dowd.

Edward Dowd and the Big Short

https://forbiddenknowledgetv.net/the-big-short-pfizer-and-moderna-the-new-enron-are-criminal-charges-defensible/

Around the end of January, Dowd really exploded into public consciousness due to a high profile appearance on Bannon's War room as part of a program entitled "The Big Short". He has since been elevated in description to "Hedge Fund Guru, Ed Dowd", but I'm not certain that's his fault. In fact, I think that's just the way narrative crafters work. But it does fuel part of what I think about "The Big [Pharma] Short". I'll explain…

For those who were hiding under a rock during the aftermath of the mortgage bond market collapse, The Big Shortwas the title of a Michael Lewis book later made into a movie that claimed to tell the true story of several hedge funders who saw the crisis coming, then timed the shorting of the market to make a megalithic pile of cash that they're all probably still swimming in. In light of that, did nobody naming that show on Bannon's War Room stop to think about the tens of millions of dollars that undisciplined retail investors might go throw down on Pfizer or Moderna put options (that they wouldn't know how to manage) looking to take part in the Big Pharma Short?! Dowd is making allusions to Enron. To hear that story makes it (corporate collapse) feel like some certain sort of conclusion, and that's going to (already has) bait people into the market game who are destined to fail. We'll come back to that…

This episode of Bannon's War Room stands out as one of the most irresponsible discussions of market downturns I've ever witnessed. Shorting markets successfully is not a simple task. It's not quite rocket science or brain surgery, but as a knowledge and skill building exercise, it's the next level just right under that one. And recognizing that is apparently still a couple of levels above "Hedge Fund Guru" or ex-Goldman investment banker. Aspects of shorting the market that are challenging:

Timing. Some people on Wall Street knew the mortgage bond market would blow up even in the mid-90s. Successful shorting required both that knowledge, and also a date range during which to invest in the short. In the case of stocks, even the simple borrowing of a stock (to short sell) can be tricky with a rush for supply pushing the cost (interest rate) for the borrow up quickly.

Understanding options. Technically, there are multiple ways to short a market, but when it comes to corporate equities, options are a favorite tool. And unlike more exotic methods and derivatives, they're available to the public through retail trading accounts.

Countermeasures. Who gets bailed out, and why? A bailout does not even need to take place at a final point after a fraud trial. Markets can be manipulated in many ways to scare or forcefully push shorts out of the market.

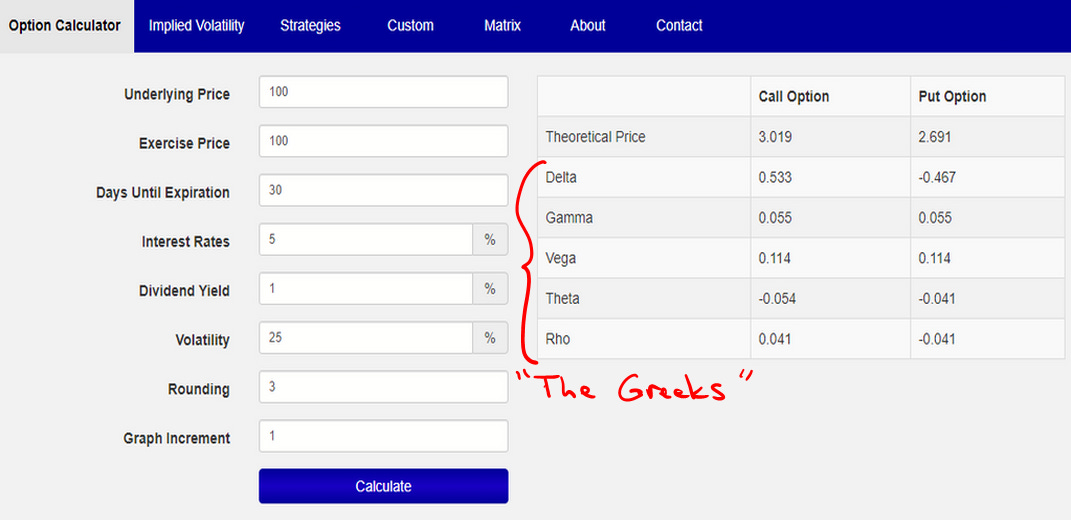

Let's focus on option pricing for the moment. Behold:

If you've never looked up the interest rate at which a stock can be borrowed in order to short sell it (because you have to borrow what you don't own in order to sell it and take a "short position") into the market, or you don't know what I mean by "the Greeks," but you want to participate in "The Big Short," then you're shark bait. If you aren't familiar with the difference between a delta-neutral strategy and a vega-neutral strategy, then you're shark bait. If you aren't sure how to smooth profits by turning a cheap option purchase into a "gamma play" by "delta scalping", then you're shark bait. And even if you do understand every one of those things, but have never spent time making a living executing trades, you're probably still shark bait.

Yes, 99.99% of the public, including the vast majority of people who have worked in finance are shark bait when swimming with the derivatives traders. This is where I need to brag in order to help readers understand. The reason my chart building skills are not as professional as those of some bloggers is because I can estimate in my head, often in a fraction of a second, computations for trading that other people spend years coding tools to accomplish. While some trading shop is spending five weeks waiting for their python coder to provide a working and tested trading model, I'm making trades every 6 to 20 seconds without hesitation.

But I'd rather eat Wall Street than to eat you. In fact, I specifically choose to trade against institutions and scammers rather than retail investors. But I can't protect you every day, so please pay attention to how much you don't know about options trading before punching those buttons.

Before I dive further into the analytics, here are a couple of clips from Dowd's appearance on Bannon's War Room for those interested:

Vaccine Makers Liability Protection is At Risk Because of Fraud

Pfizer and Moderna are like modern "Enrons"; the FDA gets its regulatory budget from pharmaceutical companies and is hiding their data.

How Have the Pfizer/Moderna Put Buyers Fared?

Not well so far, actually. If this surprises you simply because Pfizer's and Moderna's stock price's dipped a bit, it's because you haven't learned how options are really priced. But let's start with the price conversation. Shorting stock or buying puts definitely loses if the stocks don't go down. Have they gone down?

Starting from January 30, as of this moment on this day on June 21,

Pfizer stock is down 10.7%.

Moderna stock is down 23.1%.

The S&P is down 16.9%.

The NASDAQ is down 22.8%.

Shorting Pfizer and Moderna stock would have done no better or worse than shorting an average pair of market stocks, or the whole market by indexes.

But the stock prices are not really the point. Even when stock prices go down in the short term, most put buyers are still losing. And if you're not sure why, I'll try to explain a little, but I definitely don't have time to explain everything (and there are a lot of things to consider).

Was Dowd talking about buying puts?

He didn't make that point clear in the videos I watched (or I missed it), so I asked him about it in a meeting the other day when I finally had the opportunity to do what somebody else should already have done, which is to ask challenging questions. It wasn't the meeting I would have preferred, but you have to make due with the way things fall into place when the work day never really ends. Dowd said that he was thinking in terms of long-dated puts. He specifically mentioned 2024 expiration puts.

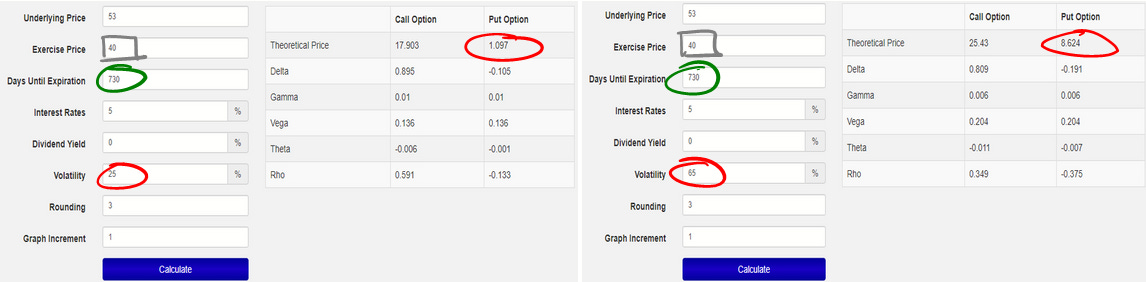

If you aren't aware of "expiration date" as an attribute of an option, or don't know what it means, I don't have time for a full article on option pricing right this minute (and you're shark bait). Just understand that the longer the time horizon, the greater the opportunity for the price movement of a stock to diverge further from its current value (current value plus interest added, really, which matters more as the time horizon grows). But we still haven't gotten to the real point, which is the interplay between the time to expiration and the "implied volatility" priced into the option. Here is an example of an out of the money put option (the kind you try to buy for cheap for a home run swing when you believe you know the future outcome of the underlying stock) with two years until expiration, priced with two different implied volatility numbers.

Notice that there's no input for "counterparty risk", so you'll have to figure that out on your own if the markets crash hard enough for financial firms to start imploding.

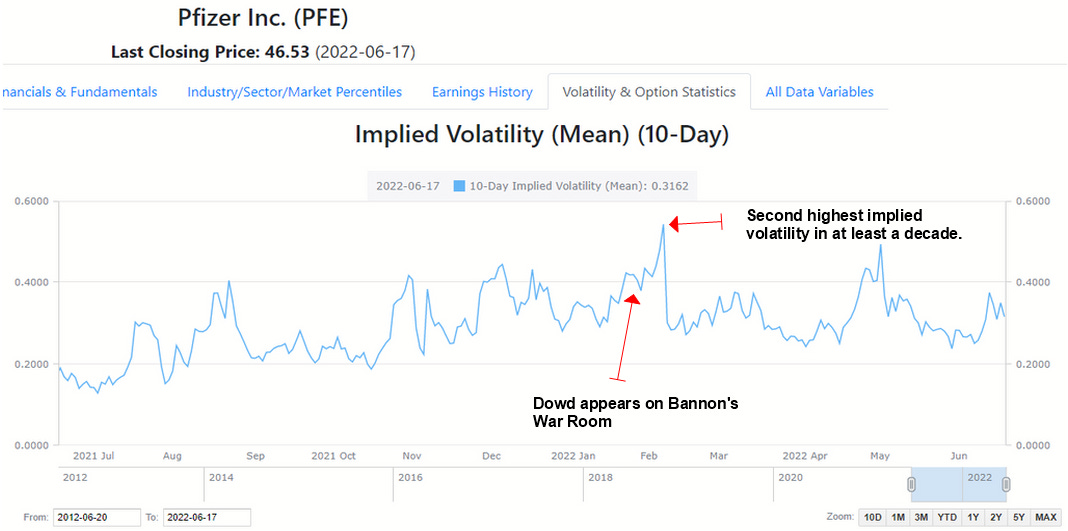

The more expensive version of the above option ("option" not "options") is eight times as expensive. Understand that this comparison is not artificial. In fact, this is approximately what actually happened in the days following the "The Big [Pharma] Short" appearance on Bannon's War Room.

These are 10-day moving averages, which mask the extreme (implied volatility did shoot up past the top line). The important thing to understand is that after Dowd spoke, the market makers who set the option prices jacked up the prices (via the implied volatility in their models) and sold retail investors an extremely expensive pile of options. Once the public was done buying, the implied volatility was dialed down, and option prices collapsed back to more ordinary levels. Despite the modest price drop, long-dated Pfizer put buyers are probably seeing their portfolios bounce around between down 40% and down 80%.

Dowd told me that he was not paying attention to the implied volatility back in January—that he was just trying to create the event. But I think the event that he created was people watching him losing millions of dollars to the sharks. Understand, that's the way these things usually go. There is a standard scheme called a "pump and dump" that involves broadcasting a message about a security widely, front running the implied direction ahead of time, then cashing out. I know because I watch for them, and I make much of my trading income predicting the outcomes of exactly these events. I then step inside the bid-ask spreads of the manipulators and give their prey better deals (I save retail investors a bit of money, cut out some of the sharks' profits, and make good money for myself very quickly).

Understand that I'm not saying that Dowd intended to create a pump and dump scenario. I'm also not saying that nobody else did. I'm still not certain, but if I'd been in trading mode (I shut down 99% of my trading to help people survive the plandemonium), I would have jumped to sell naked puts to the put buyers in a heartbeat as if this was a [put buyers'] pump and dump. I have a nearly 100% success rate with such trades.

After telling me that he was just trying to create the event, I asked about "The Big Short" and it took him a moment to even realize that was the name of the Bannon War Room episode. He then said that he does not advise on trading. "People take their own risk." That's when he said that professional investors ask him his opinion, and [privately] he would tell them that they could buy 2024 puts.

How to Collect Your Winnings While the Casino Burns

Nobody goes to a casino manager in Vegas and bets them that their casino will burn down. There is always a chance that you can't collect on some bet you make because the counterparty in your wager went belly up. That's counterparty risk. In cases like this, you're mixing your counterparty risk with the actual result. This is just one of the several reasons why there are entire classes of market wagers and investments that simply should not exist, rationally speaking.

I asked Dowd how shorts would collect their winnings if the markets break down. He seemed to stutter over the question at first in a way that suggested that he hadn't thought about counterparty risk. He then settled on, "If the whole market fails, then everyone's in the same boat," but I'm not at all sure that's true. I personally think that there is a bridge that will be gapped by people who use their resources most wisely. I was disappointed that Dowd dismissed the idea of locking up capital long term.

More interestingly, while taking other questions from other people a short while later, Dowd repeated something I've seen him say (in so many words) in other interviews, which is that we're looking at a period of global system risk of economic collapse. Amazingly, he has compartmentalized the bet (The Big [Pharma] Short) and the counterparty risk. He hasn't recognized the contradiction. I would also worry that he hasn't recognized that he might be opening himself to legal risk.

If you're even thinking that the models of the past apply, you could be catastrophically mistaken. When all cans get kicked down the road to the same spot, they do pile up.

Viral FUBAR?

I've taken the opportunity to repeat at least the discouragement of thinking that

(1) information equates to market movement (particularly when the markets are breaking), or that

(2) successfully profiting with options trades is anything like simple (I certainly wouldn't trust Dowd at an option trading desk).

Here I dropped the basic (2) message on an exceptionally good Tweet about potential Pfizer trial fraud.

I once again (responsibly) discouraged internet denizens from trading. I fully appreciate that it's fair to actually ask advice on how to trade. But let's be realistic: trading lessons at the level of shorting equities or equity options just aren't going to happen over Twitter between people who don't already know each other very well.

What happened next pissed me off. Igor Chudov decided to chime in, glibly, with a claim that he profited from Moderna puts. No discussion, no receipts—just a claim as if to belittle my reasonable warning with an unlikely proclamation of victory, as if that's no problem at all.

Igor should be capable of having this conversation on a technical level, though it's perfectly possible that he never studied finance. Weeks later, he still hasn't offered receipts, much less anything like a basic analysis of his play (if it happened, which is possible, but I doubt). Igor frequently promotes Dowd on Twitter, so perhaps he got wrapped up in some emotion?

The retweet message (Dowd's is now unavailable) is fine and all, but Igor shows no particular expertise in evaluating Dowd's story. This sort of moment casts doubt on Igor's expertise in general, which is a shame because I have agreed with the majority of his work (though he does write authoritatively about some topics where he should spend more time learning prior to posting).

Does nobody consider it good journalism, or perhaps ethically necessary to seek out independent expert analysis for the sake of getting a story like Dowd's right? Does Igor not consider it an ethical duty to show receipts of his claim (which I simply disbelieve without seeing evidence that he threaded the needle or made a quick entry-exit from the market)?

Shark Juggling

It is far more responsible to tell people not to try juggling the sharks. Sure, there are a few great traders out there—but nobody has to tell them which way the market might go, and they already know who they are. Everyone else is shark bait, more or less. Sure, there is only around one human death due to shark attack for every billion years of human life spent, but that's at least partially because we don't encourage people to swim in shark infested waters.

Diseconomics: Misdirecting the Outrage Supply

One of my issues with the Bryan Ardis "Watch the Water" story, aside from the fact that the water supply was the most speculative if evocative part of the story (and that the facts weren’t well understood by him (and he dismissed opportunities to discuss them with experts)) is the fact that it wasted millions of hours of truly righteous anger that might otherwise be directed into productive action. For a similar reason, I chose not to write about graphene oxide without further evidence, the presence of alien babies in the vaccines, or promote "hot lots" as a story when I could very plausibly explain the effect without the need for vaccine contamination. After all, there is plenty enough evidence already that the vaccines are simply ineffective and dangerous without going there, and false leads improperly worked about among experts ahead of time are a form of time theft, whether intentional or not.

Talking stock prices is a bit different, but not by much.

Maybe I should have called more people and warned them, but I was plenty busy with the initial DMED analysis these past few months. But understand what that means: you're on your own. Of course, you always were and always are, and it's important to understand that at all times. And you should treat all information that comes through the magic source box as if it's potentially adversarial. Even if it seems to be coming from The Rebel Alliance(™). Even if the information was handled by, and delivered by sincere people (and I do believe that Ed Dowd is sincere), it might still be a trap.

A Silent Partner

Dowd mentioned that he has a silent partner who is an anonymous ex-Wall Street insurance analyst. He says that they're trying to force the hands of insurance companies through shaming in order to get a release of data showing vaccine harms. He wants for those insurers to realize that they're the bag holders of fraud, which Dowd describes as happening at the trial level. Obviously, I hope that this is the case and that action over fraud begins soon.

My questions to Dowd were uncomfortable, as designed. Somebody else should have asked the hard questions months prior, but it is what it is. I get to be the @$$#0%& messenger.

But at least I got the right look. What I got to do was watch Dowd's genuine emotional response to my questioning. When he realized what I was asking, he looked for a little while like I'd kicked his puppy in a way that I doubt that he could fake. In other words, Dowd doesn't strike me as controlled opposition. He just strikes me as somebody who was being pumped up in an irresponsible way while talking about a level of quantitative derivatives trading and analysis that is beyond most stock portfolio managers.

On the other hand, I can't vouch for anyone I've never met.

The New Subversive Media Boost

Over and over, a new champion emerges with a new narrative that combats the old narrative. Then they are persecuted by Big Tech and the Major Media. Once banned from Twitter, the crowd of Official Narrative (ON) fights galvanizes around the new champion, propelling their image to new heights.

This effect for promoting the New Opposition Narrative (NON) works effectively, and without respect for whether or not the NON is healthier or more factual than the ON. Will this lead to another round or two of undereducated retail traders throwing money into the long-shot shark pool?

Hopefully I've prevented any more of that.

Man, you're way too smart. But then again maybe I'm not smart enough to know how smart you are . . . .

But thank you.

Like you, I can't vouch for anyone I haven't met, but you seem to be an ace person and I'm glad you're fighting for a kinder world.

I try to read everything I can from both Mathew and Dowd. A couple of things the two have in common from my point of view as an educated person, but NOT knowledgeable on the topics at hand (vaccine safety nor finance) is that both of them know far more than I do, and both of them feel a strong sense of urgency that everyone else understand that the vaccines are killing people unnecessarily. And both some across to me as sincere, although I admit my BS detector has been fooled in the past. I personally have acted on nothing more substantial than Mathew's advice to grow a garden. (My receipts: about $200 at Home Depot resulting in one squash and about two dozen tiny tomatoes...that is, some of us can lose money at even that game.)