Find other articles on the Culture Wars here. Join the RTE Locals channel for more discussion.

See Part 1.

Apologies for the delay. Nearly all of this was written two weeks ago before a six-day trip and other exciting projects diverted my attention. But this is an important and highly politicized moment that deserves careful attention.

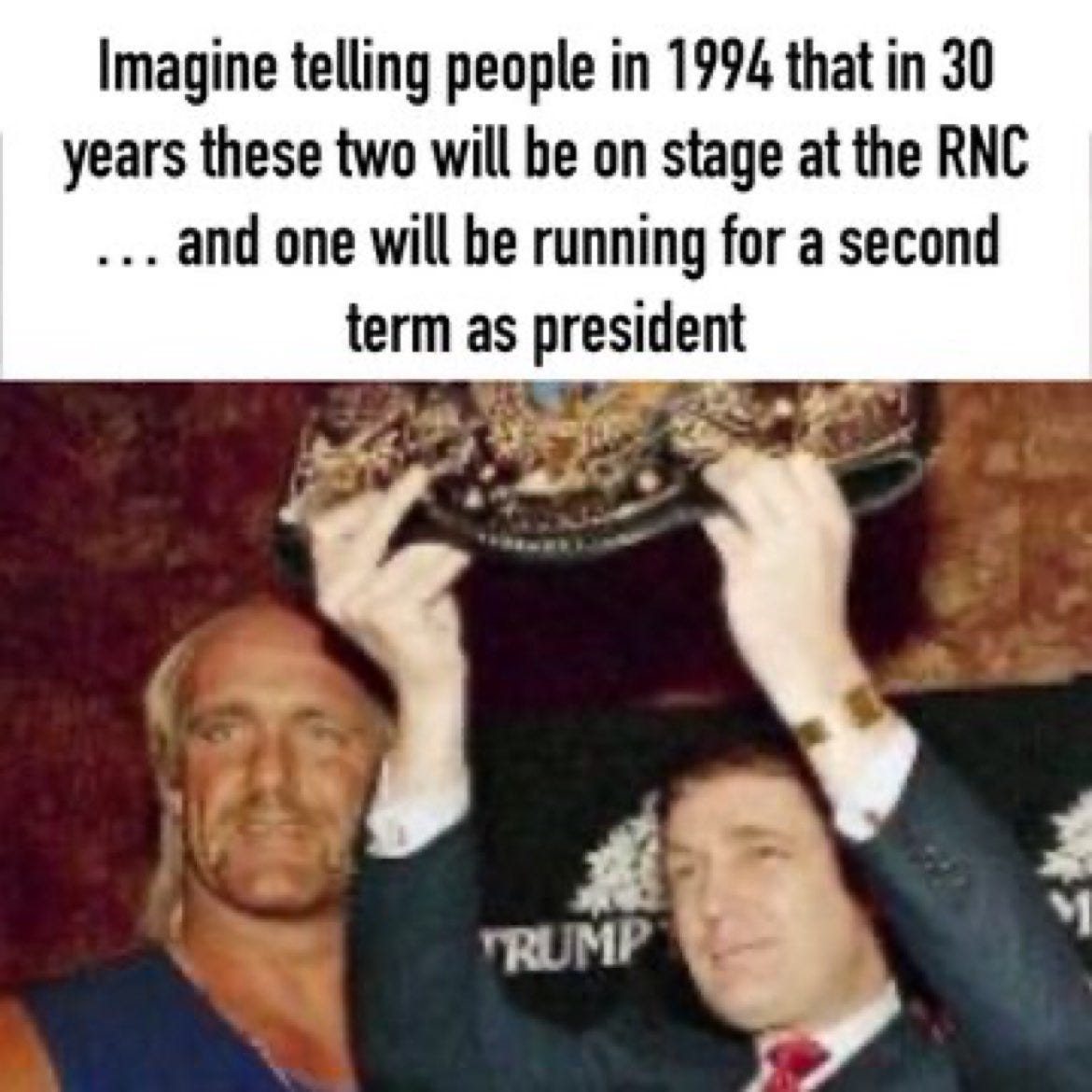

When Peter Thiel puts Hulk Hogan into play, does it matter that the chessboard was pre-arranged?

It's time to sort at least some of this out on a Meta-level, even if many of the details are obscured.

What Stories Do the Markets Tell?

This is right up my professional alley. Unfortunately, I've had only a few minutes to dive in. But the story is very interesting!

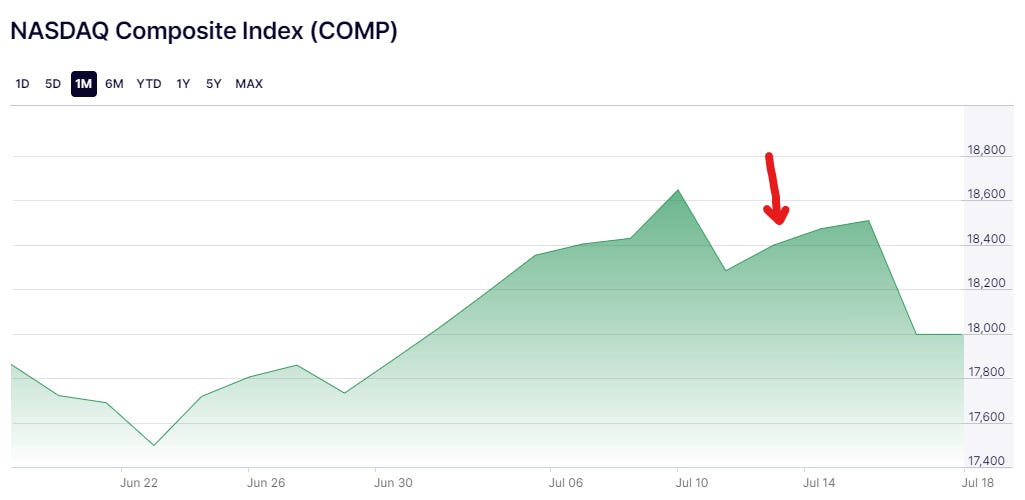

The most interesting observation about the financial markets in the wake of what is being called an attempted assassination of Donald Trump may be that what happened in the markets, overall, was not interesting.

If by some chance you somehow managed to miss the Trump rally news over the whole weekend, and opened a window to check the markets on Monday, you would have had little indication that a major event had taken place. That's…curious.

An earnings event for a single Fortune 500 company would likely have caused more waves.

The NASDAQ did have a hiccup on Wednesday based on discussions of the over-hype of artificial intelligence (told ya so). I suspect that an assassination attempt on Taylor Swift would set off more market reaction than did the events in Butler. Just how important is "the leader of the free world," again? That's what people are voting on in November, right?

What have we learned?

The (lack of) broad market signals might mean,

People in market finance recognize that all the world's a staged psyop, or

The partisan election process makes no real difference in practical world economics.

Either of these would be a worldview spinning conclusion for most people, and I suspect that both are at least largely true. The second point could be specific to this election, but I suspect that we have entered a world in which conflict between the oligarchs of the Military Occult Banking Syndicate (MOBS) are settled, and elections are not real contests.

While the macro market view told us much by telling us little, there were some specific observations of market action surrounding the events on July 13. I'm going to say up front that I lean away from thinking that any of this information adds a lot to the story, except that pundits will try to direct attention with them.

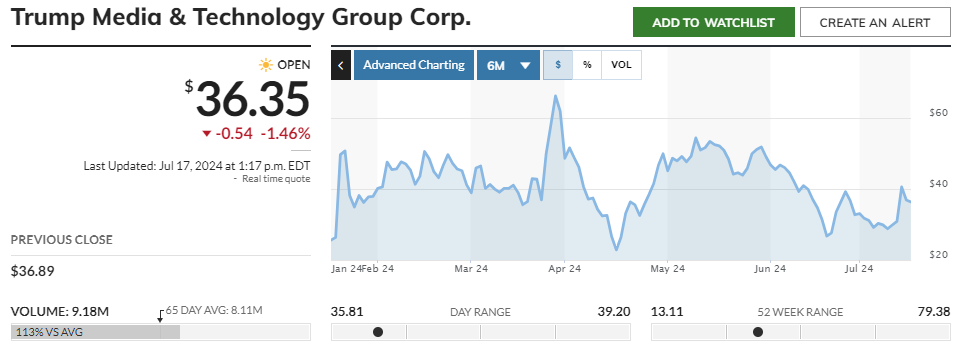

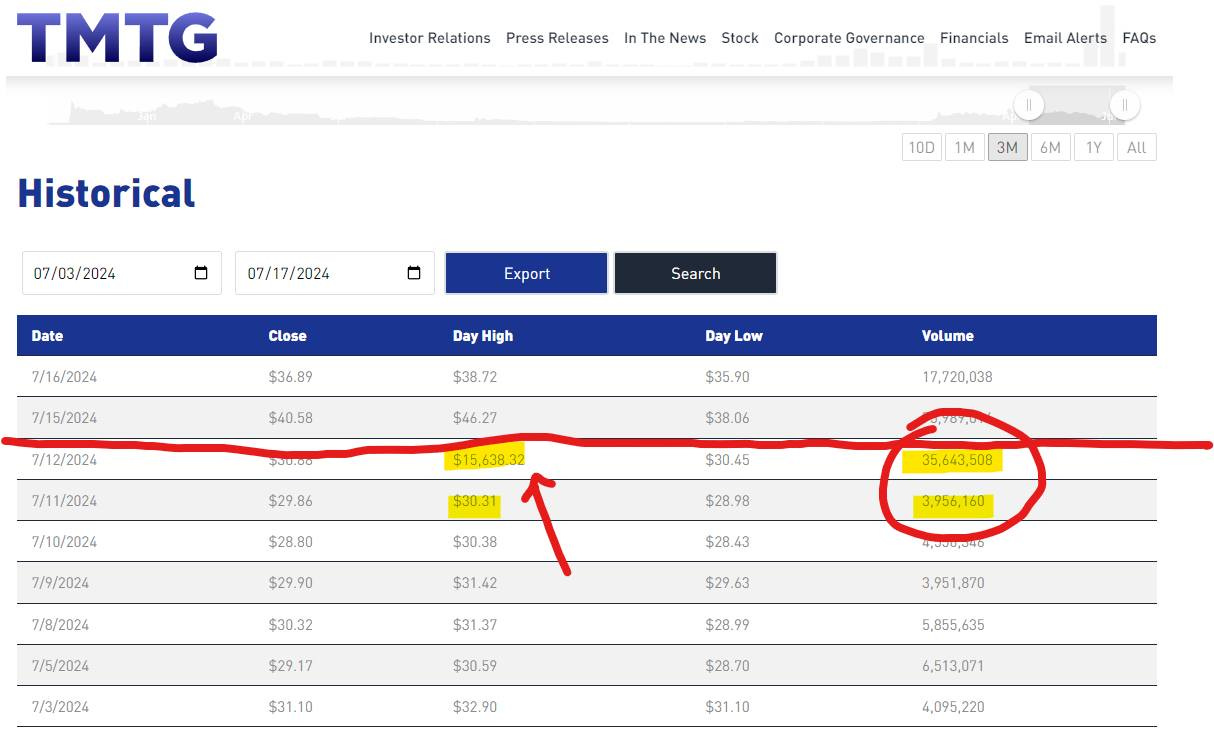

The DJT ticker represents the Trump Media Stock. During the first twelve days of July, shorts on DJT. Does this represent inside knowledge of an assassination attempt?

Maybe. Probably not. It is worth noting that there has been financial warfare surrounding DJT ongoing throughout the year. From Forbes on May 1, 2024:

The Trump Media anti-short selling campaign has unwittingly played into short sellers' hands. After short sellers "covered" their shorts (i.e., bought shares) in the $20s, they have been biding their time, waiting for false claims of victory. It looks like that time is here, and the short sellers are stepping in again.

An apparent, perfectly-timed contrarian indicator: Barron's (May 1, 6:16 AM): "DJT Stock Is Still Climbing. Trump Media’s Short Selling Campaign May Be Working"

30-minute bar chart shows apparent turnabout on May 1JOHN TOBEY (STOCKCHARTS.COM)

Trump Media’s anti-short selling campaign is twofold: (1) Publicly malign short sellers and (2) Tell Nasdaq and Congress to do something. The stock's quick rise from the low $20s to about $50 yesterday gave an appearance of success.

However, the campaign and the stock rise have actually set up Trump Media investors to experience and learn this basic truth: Both long buyers and short sellers help ensure proper pricing.

Were I trading this year, I'd probably have DJT on my list of stocks to pay attention to. Any time retail traders are invited into a market to "do battle", the professional traders win.

Now, let's take a look at the broad price action in DJT since January:

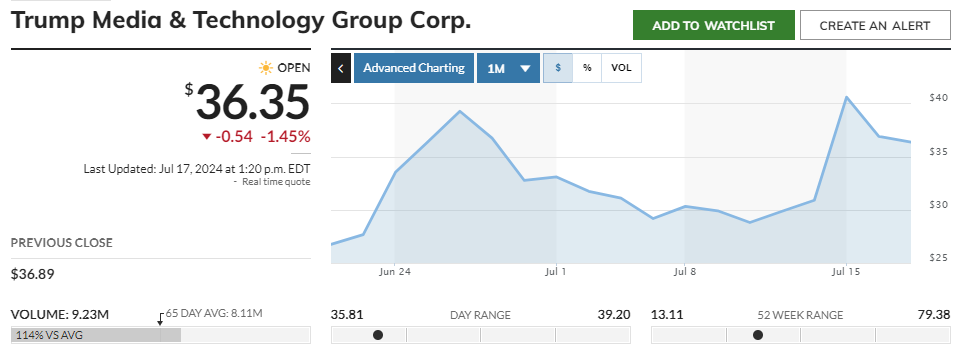

Okay, so shorts were pushed out in early May, leading to a bump, but those gains did not stick. Would it be plausible for the shorts to jump back in for the early July period? Sure, if the market felt that the price had risen beyond a reasonable level (or traders just wanted to be spiteful again):

There certainly isn't enough evidence from this brief examination alone to justify taking a strong view. My needle leans strongly toward thinking the early July buildup of shorts had nothing to do with the assassination attempt. However, that didn't stop some Trump partisans on X-Twitter.

On the other hand, there is a more interesting story involving a single, localized actor: Austin Private Wealth, LLC (henceforth APW). It had been reported by some earlier this week that APW purchased puts on a massive 12 million shares of DJT. However, APW did file a very plausible correction (to puts on just 1200 shares) a day before the Butler rally, so they could not have directly profited from a Trump assassination to some extremely large degree. And really, such a position would be highly unusual for such an asset management firm. Such firms are not your typical Wall Street gunslinger class of traders.

The pre-rally correction of the puts indicates that the firm was not likely trading on the event. Technically, it is possible that foreknowledge allowed them to create this strange little "advertisement," (no publicity is bad publicity) but this is not at all the sort of signal that I would consider strong evidence of anything.

Add that to the fact that a massive 120,000 lot put trade certainly would not have gone unnoticed. It strikes me as implausible that managers of a firm, building themselves nice, cushy jobs, would put their futures at risk for a one-time profit that would certainly have been heavily scrutinized. How many years of jail time would you risk for a one-time 10% bump in your portfolio? Don't think the assassination overlords would be unhappy when you tip the hands the MOBS arranged?

Conclusion: This edge story of conspiracy is not very plausible.

On Monday, July 15, DJT price shot up before coming back down to Earth. I suspect that short sellers panic-bought. A few may have been liquidated. Then traders dumped longs at the inflated prices. None of this activity suggests anything nefarious.

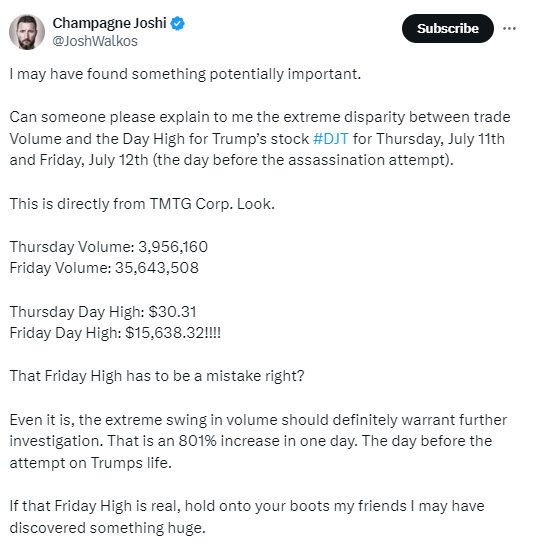

I was however made aware of a more interesting piece of apparent market action.

A 50,000% intraday price increase is not just a price boom. This almost certainly represents an execution error in the form of a buyer who intended to purchase more shares than were available at reasonable prices, which fits the volume spike. Let's check the running history:

Understand that this may be a "dumb chart" in the sense that trading may be taking place over the weekend that gets categorized in the Friday date. There is also the possibility of a single glitched trade print. Since I'm currently not trading, I do not have access to a terminal that would answer that question easily for me, but friends of mine who are currently trading seem to concur that this is once again not likely . For the moment, I'm holding this in the "quantum evidence" zone.

Here is what I would think if the Friday data does not including weekend trading:

I've seen many spikes and dips like this, and there are two reasons this happens: (1) the person trading does not understand market depth (liquidity), so they put in a market order that gobbles up the order book all the way up to some insane price that will make them want to go hide in the closet and cry, or (2) there is no other option but to dump some position and exit the system. But (2) is nearly always a price crash relative to the basis (currency).

Even if somebody bought through the liquidity, that would not necessarily indicate foreknowledge of the event in Butler. That just happens from time to time. However, I will hold out an open mind to the possibility if clarifying information emerges.

Let's move on to more important things, shall we?

All the World is Kayfabe?

From Wikipedia,

In professional wrestling, kayfabe (/ˈkeɪfeɪb/) is the portrayal of staged events within the industry as "real" or "true", specifically the portrayal of competition, rivalries, and relationships between participants as being genuine and not staged. The term kayfabe has evolved to also become a code word of sorts for maintaining this "reality" within the direct or indirect presence of the general public.[1]

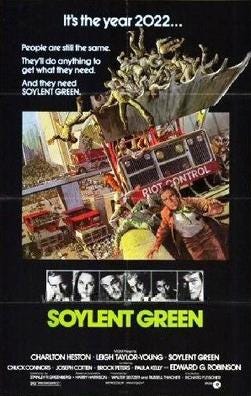

Did you ever watch that old Soylent Green flick that your drama and literary teachers raved about?

I once helped a friend make a Homecoming banner declaring that the rival school, whose team colors were (primarily) green and (I think) white, were in fact people. I didn't care if most people missed the joke. Ah, simpler times.

On that note, watching old movies is a great reminder that propagandists were working on a smarter audience two generations ago. There is a lot we could call goofy about most any old film, but the storytelling was so much better. It had to be. Prior to this age of governance by total media saturation, people had to read to consume a story, and readers are harder to psyop.

Readers are harder to psyop.

Fast forward to the end of the film (spoiler alert), and the hero's (somewhat) elderly roommate voluntarily enters a facility to be euthanized. The death took place in a room with controlled sounds and images, amidst the backdrop of a beautiful, calming landscape that might very well have been put together at the Esalen Institute. Ahem. The world had evolved to the point where people could find no way to exercise even the most modest creative power to make any of their lives better. Also, when people ate ze bugs, it was actually recycled human protein.

What the dystopian world of Soylent Green lacked was today's circus management of perceptions prior to the euthanization centers. The FBI was not yet running so many operations to cut off the action potential of grumbling masses, and professional wrestling had not yet merged with politics.

I imagine there was a conversation that went something like this:

In 1998, I was a rookie trader at a large hedge fund in Manhattan. The trader who trained me to take his position running the Asian Bond account, Bill, got upset with me one night after finding out that I support the Second Amendment, and think that for many people, being armed is just smart. He literally got up from his chair and stomped around the room telling me in a loud and superior voice that his position had been "proved" (without ever hearing me explain my position beyond a sentence). This was clearly a religious issue for Bill, and I was suddenly othered, as if a Sunni setting up shop in a Shia marketplace.

Bill was a Princeton University graduate—one of seven (out of seventeen of us) in the bond trading unit at D.E. Shaw. Bill was a programmer with an interest in artificial intelligence whose career I suspect diverged in that direction after the Long Term Capital Management (LTCM) fiasco gutted the bond room at the end of the year. From what I could tell, Bill's politics largely conformed with what you would expect from Princetonians graduated in the 80s or 90s. He grew up in an affluent (but not super rich) home, but had a bit of a grudge against the conservative oligarchs and neocons, and probably saw himself lower on the economic scale than where he was (which was very high). I was an ever-so-slightly left-of-center twenty-year-old from Alabama who did not have the money to pay for an application to Princeton because I could only afford one application fee. I think at that particular moment, due to one conversation in which I probably did not get out twenty words, Bill typecast me as an ignorant country conservative, more or less. The story is more complicated than that, but the payout isn't worth ten more paragraphs.

Two or three months after that conversation, I wound up eating a meal at a restaurant bar next to a lawyer whom I let talk my ear off. He had worked in the wrestling industry. He explained to me that in addition to being dramatic entertainment, the wrestling industry was all about political analytics. Characters, and their dialogue, were constantly being used either to push messaging on the audience, or finding out how the audience would respond. In particular, we talked a bit about a wrestler known as the Iron Sheik.

After the meal, I headed to the office to set up for trading hours (which started in the evening since I was in New York talking to broker dealers in Tokyo). I turned on the TV, and wondered if there would be any wrestling on. Was the Iron Sheik still active? Were there any new ethno-heroes or ethno-villains? I was curious to see what sorts of politics they were selling. On a grainy station that barely came through, I found a wrestling show, then turned to my computer and began to absorb the state of the market ahead of the open.

Right about that time, in walks Bill.

By that time, I had taken over the Asian bond account, but Bill would come into the office once or twice a week, supposedly to help me continue my education in my first year of trading, but there wasn't much instructional conversation taking place by this point. Most everyone was too busy managing the emergency of the LTCM crisis.

Bill stops and sees wrestling on the fuzzy screen and begins to throw a tantrum. Because what value could there possibly be in understanding wrestling as a form of media?

Most of the time, the TV would either be off, or some sort of Market News would be on—even though we got 99% of our practical information from the Bloomberg box, or over the phone. That said, it wasn't that odd for somebody to put on a sporting event. Numerous times I walked into the trading room while tennis was on, and several of us watched Mark McGuire break the home run record live. Ultimately, while this brief instance of wrestling on a TV meant next to nothing, it gave Bill the opportunity to carry out a moment of directed outrage.

And that's a shame. Several times I began to open my mouth and begin the conversation about how this form of media shaped political messaging. An older, more experienced version of myself might have lobbed the right conversational flash bomb into the whirlwind, but Bill just sort of marched out of the room and didn't even return for the night.

I've been telling that story now for more than twenty-five years, including again (recorded earlier in July, prior to the Butler chaos) with Courtenay Turner. I keep hoping that it will help some people stop and reset their mental orientation with respect to communication and culture war. So long as people are overly quick to organize games of local domination, the rulers need only run the occasional mindwar operation to succeed at the metagame of divide and conquer.

If the typical elite university graduate could stop feeling superior long enough to have such conversations, and use what they learned to lead, we would not be living in such a viciously divided nation. It has been terrifyingly ironic how masterfully the oligarch strategists have throttled the usefully educated over this superiority complex.

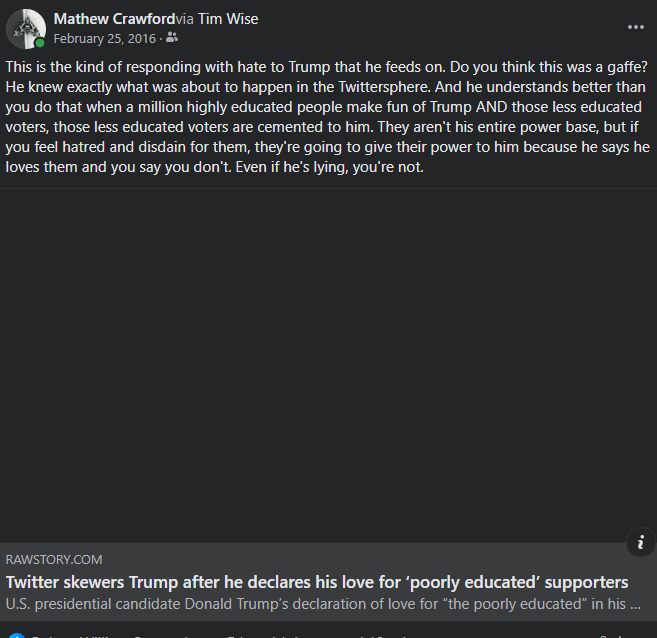

My experience is that they're often too busy looking onward and upward, often thinking that they're serving some goal that will break the oligarch network, but far more likely ossifying that power. Usually that just means building the technology that drives some company that will be sold up the corporate chain of consolidation. More recently, it is nearly impossible not to recognize the role the Bills of the world play in pushing people to elect Trump.