Discover more from Rounding the Earth Newsletter

Nuclear Debt Theft, Nuclear Monetary Supply, and Nicki Minaj, Part 1

The Monetary Wars Part VIII

"When I win and when I lose, I take ownership of it, because I really am in charge of what I do." -Nicki Minaj

This article is not going to be what you think it's going to be. If you're not sitting down, take a seat. Buckle up, take a deep breath, and hold on to something.

This is not another alarmist story about the U.S. national debt. It's far more accurate than that. And it gets weird. After that, it gets weirder. Then it gets, "Serial tech-geek entrepreneur Steve Kirsch just wrote an extremely well-sourced 29-page defense of rap-mogul Nicki Minaj's White House-concerning worries about COVID-19 vaccine safety expressed in tweets about vaccine-induced swollen testicles" weird.

Don't say you weren't warned.

Good. Sitting down is good. Let's get started...

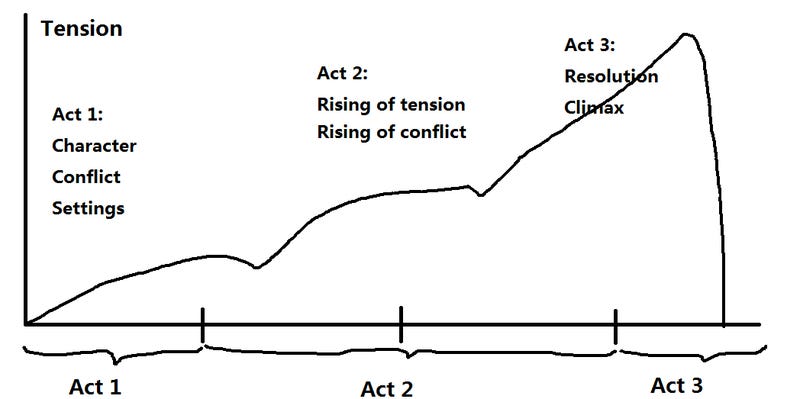

Act I: From Debt Alarmism to Weird

The U.S. national debt stands at around $29 trillion dollars today.

"HOLY MOTHER OF GOD!"

Be calm. We're just getting started.

Such a sum of money seems truly mind-boggling in a world in which the entire global currency supply stands at around perhaps $90 trillion, or perhaps a little over twice that amount if we include all the equity in the stock markets. Even worse is that when we add under-funded and unfunded liabilities to the mix, the U.S. debt total exceeds $123 trillion---a full two-thirds of the world's entire supply of money and corporate equity.

"I could actually afford a house with that kind of money."

Hang on to that thought...

If the swollen U.S. balls of debt story (see what I did there?) seems concerning, the story quickly gets weirder. You see, the federal government owns more than 27% of all U.S. land, including nearly half of all the land in the Western states. A 2013 study by the Institute for Energy Research suggests that U.S. federal property is worth a whopping $200 trillion dollars, including $128 trillion in [currently] recoverable oil and gas resources. Such a sum may not even include the swiftly inflating value of land today, and the improved production abilities brought by new technologies. These assets might total between 20% and 25% of all the world's wealth.

So, is our government broke, flush with cash, or something else?

Understanding the [monetary] state we are in is far more complicated than decoding the sexual references in a Nicki Minaj hit, and it gets increasingly more complex when we throw the Federal Reserve and military-intelligence complex into the mix. If you thought we were on a roller-coaster ride already, you ain't seen nothing, yet. We haven't even gotten to the part where the Department of Defense managed to spend $20 trillion off the books in the span of only 17 years.

"The hell you say?"

Precisely. Go ahead and pour a glass of scotch. The good bottle. I'll be here.

"What could all that money do?"

It would have been enough to give every graduating high school student during that span around $300,000. There would be essentially no student loan debt, and millions of businesses built by a wide variety of young entrepreneurs leading what would likely be a dramatically more dynamic economy. Young people could buy homes and raise families. Sugar Baby University wouldn't exist. The Malthusian mind virus could be entirely defeated already.

"Sugar Baby what? Does all this mean it's not the [Other] Party's fault? It's still the [Other] Party's fault, right?"

Well, somebody's been having a party. But if you've started to get the feeling that the narrative is all wrong, and that almost nobody knows who the real problem is, you're making progress. If the first dose made you woosy, that just means it's working.

"Comprehensive annual financial report"

This site documents the way local governments use a sleight of hand to turn assets into liabilities.

"HISTORY: It has been reported that trillions of collective dollars not shown in government Budget reports are shown through Government CAFR reports and they are virtually never openly discussed by the syndicated NEWS media, both the Democratic and Republican Party members, the House, Senate, and organized public education, and as in such over the last 50 years the domestic and international investment assets of US Federal and Local Governments as a whole have taken over the Stock, Derivative, Insurance, and Debt Markets. The collective private sector's assets and investments as of 2000 are now insignificant in comparison with what US Government now owns by and through investment."

"With, and being that the CAFR is "the" accounting document for every local government, and with it being effectively "BLACKED OUT" for open mention over the last 60 years, and that this fact of intentional omission of coverage is the biggest financial conspiracy that has ever taken effect in the United States"

"What Government, both political parties, organized education, and the syndicated News media have presented to the public over that 60 year time period were Budget Reports. A Budget report is strictly planned expenditures for the year from a grouping of specific government service agencies. A budget may also note some statistical, statutory, and demographic data for reference. Most Government budget reports show where "tax" revenue will be used. The CAFR on the other hand is not a projection of one year's expenditures from a select grouping of agencies, but a complete cumulative record of assets, investments, and gross income from all agencies and all sources benefiting or held by that local government body."

"A CAFR is the counter part to the Annual Financial Report (AFR) that publicly traded corporations are required to produce each year and give to every share-holder as a requirement of Securities Exchange Commission (SEC) law. In many cases, a CAFR may show two to three times more income over what is shown in the corresponding Budget Report."

http://cafr1.com/

http://cafr1.com/SilenceisGolden.html

http://cafr1.com/listings/Listings.html

I figured the US will just inflate the economy until the debt is manageable again. Essentially, folks and institutions holding US securities will pay down the debt.