Find other Bitcoin Wars articles here. Find more discussion at the RTE Locals community.

Much thanks to Hrvoje for hosting, and to Gabe for joining the conversation, delving into the fray from a different vector than the ones I see as easily.

Tereza Coraggio asked some questions in the comments that will guide this article portion of the conversation. I write better than I speak, at least when I'm as exhausted as I've been these past three years, so it was good to have the prompt.

Some Bitcoin Basics (and More Advanced Concepts, Too)

The best way to start to understand Bitcoin, without getting into the technical side of the mining algorithm, may be stated simply as,

Replace the banks and their staff with Bitcoin mines that run a networked ledger.

I say "start to understand" because any intersection of math, computing, and finance can go deep.

Obviously, that's a big shift for a Military Occult Banking Syndicate (MOBS). But it may be an "all boats rise" shift, resulting in greater wealth for MOBS players [who don't miss the boat] and also the world's less wealthy laborers.

The changes in the system that should result, assuming Bitcoin wins the "Gresham's law tournament", are

Decentralization over control of the banking process,

No more "taxation through inflation",

No more using fiat currencies to launder trillions in wealth,

All the energy used to run banks (including the lifestyles of those running that system) will be channeled into a more optimized system that encourages development of new energy resources. At its core, Bitcoin is a solution to an energy optimization problem.

Dark markets (organized crime) will become less profitable due to being more expensive to run. The current banking system is dependent on those schemes, which forces small, honest banks to consolidate into the banking behemoth. This is part of why human slavery persists in so many forms,

Remittance fees of 35-40 percent (that keep migrant workers from saving) will no longer go to banks. Billions of [current value] dollars will buoy poor economies. Generational wealth will transform starved nations. Children will grow up happier, healthier, and better educated.

The currently maligned "volatility of Bitcoin" will cease as its value becomes relatively stable, growing according to wealth growth (demand for capital stock), and fluctuating largely according to the sum of capital deployment decisions.

I also think that large corporations will break up into smaller, mostly more nimble and more profitable units, but that's a long conversation that deserves its own article. Those units that are subsidized will see a reduction in investment. In summary, the reduction of horizontal corporate scale should lead to an era of dynamic optimization in capital investment that I suspect few people currently recognize.

Managers and employees of the current banking system will have to find new jobs providing value in a way other than laundering money or providing free checking at local fronts for the global criminal syndicate. The same is true for those employed by the current welfare-warfare state. These are the people living on the largesse of a negative sum game. While this may result in some upheaval, a transition has always been inevitable. While I have basic human sympathy for the plight of such system zombies, and all they went through, that sympathy is limited and balanced by the benefits to all other families whose labor fed theirs.

Energy resources such as stranded gas (which is currently flared off, resulting in unnecessary pollution) will be developed, so the net energy used to run Bitcoin mines is a small fraction of what is actually used. All economies are energy economies, and the purest incentives lead to the least waste and lowest externalities.

There will be less incentive to mine the Earth for metals, except according to their technological values (those which scale our ability to use less energy to support ourselves). Energy optimization generally goes hand-in-hand with optimization of negative externalities. Under the best definition, they are one in the same.

There is a lot of talk about "intrinsic value" of currency, but the topic deserves less discussion than it gets. When was the last time somebody melted their money down to fashion swords or plows? I almost hate answering the discussion because we have far larger intrinsic worries about "value" intrinsic to living such as organ harvesting and human trafficking. The crops you might grow from seeds out of food you bought at the grocery store is a more serious discussion of intrinsic value than any money that [at least] 99.9% of the population ever uses. That is to say that the "intrinsic value discussion" relates fundamentally to the rule of law that underpins civilization than it does the monetary system specifically.

While Bitcoin (BTC) would then primarily serve as the reserve currency, there are multiple possible endgames for high velocity currencies—the ones you would typically purchase groceries or coffee with that require less security than a BTC mining transaction (tx) fee:

Computer scientists will find ways to make BTC scale, introducing less secure, but lower fee transactions. This may result in some opportunities for petty theft (a long article on how/why), but those talented enough to pull it off may be promoted into better jobs!

A standard (status quo) fiat currency system (Tereza calls these "imperial currencies"),

Central Bank Digital Currencies (CBDCs), reducing the costs of banking on the system, but increasing the surveillance control grid currently run by criminals (I hope not),

People carry around large and small pieces of metal to exchange (I very much doubt it),

Another principled protocol develops and takes over. My preference would be an education coin. After all, education drives technology, which drives the economy, so an education economy is perhaps the only economy that absolutely must exist in perpetuity aside from the energy economy.

Something I'm not smart enough to have thought up.

Nations will still look for ways to tax people. Perhaps CBDCs will succeed (not my preferred solution). Some nations may simply run BTC mines much like some government revenue comes from oil and mining interests, fully socialized or not. Toll-based infrastructure projects are sometimes more effective than we would like to admit. The Dallas tollways where I live are generally excellent in flow and safety, despite the rapidly growing population. The infrastructure pays for itself. There will be less need for military expenditure as soft power (see the "Softwar" thesis) resolves larger conflicts of interest without violence.

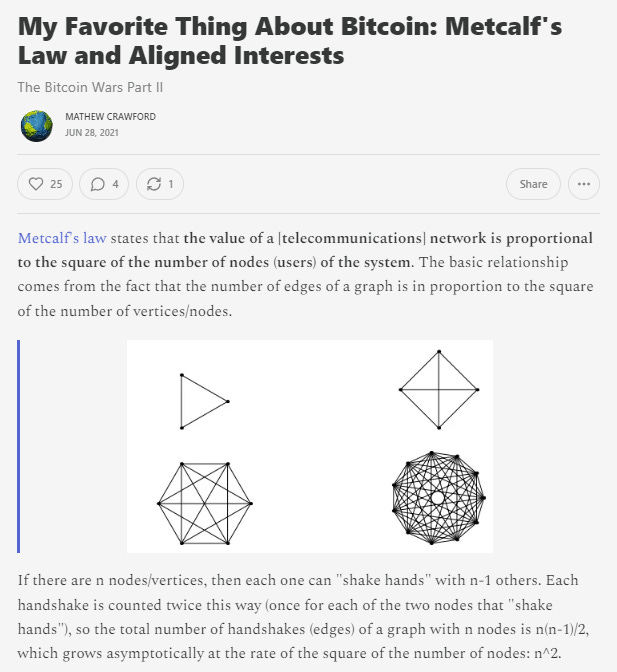

My greatest hope for Bitcoin is that it results in aligned incentives due to a combination of Metcalf's law and lower power held by tyrannical groups. This is easiest to understand in terms of education.

Imagine the difference between the status quo, where people are encouraged to sabotage the education of each other's children, and a world in which everyone understands that their own savings are worth more when everyone else's children become more productive. This is the future I focus on when I think about the value of monetary Bitcoinization.

I do have sympathy for Gabe's concern that Bitcoin doesn't solve privacy issues. Ultimately, the design of a system like Bitcoin makes trade-offs. It only wins the Gresham's law tournament by focusing on security [over privacy], and digital currency only comes into existence when one of them wins that game. However, this means that a privacy coin may exist due to Bitcoin. It will lose value relative to BTC over time, but that may be the lowest value bleed possible, under the right design. If BTC wins, you can bet some Bitcoiners will increase investment in such technology (they already do).

Bitcoin doesn't solve all the world's problems. But it looks like a Pareto improvement to me, and we may come to measure that improvement both in terms of greater global wealth, and quality of life (human and flora/fauna) as that wealth is better distributed with a better incentive structure.

I've recently been exhausted and ragged, so commenting will be set to subscribers only, and I may not even check them.

This article was perfect timing Mr Crawford. No need to reply. Just wanted to say, thank you, I love your work and your encouragement to readers to keep learning, researching for ourselves inspires. While I can't keep up, have limited time and/or cannot understand and follow everything, I find your articles both fascinating and full of incredible research and revelation.

Much appreciated.

At your "I may not even read them" warning, I'll take the opportunity to wax philosophical.

When I comment, its usually from a place of excitement to share. As a person, I feel deeply much of what you are concerned about and appreciate some of the clearest and sharpest attempts to peer; even when it makes you stand out as a target.

Just knowing a guy like you exists (and by the way your face reminds me of my cousin), is motivating to me.

It is always my wish that my comments might make you feel something similar.

We are out there, working, perhaps not as vocal as you, but thousands of us I am sure. Thank you. Bless you. You do you, because we are doing "us". And everyday we are less fooled.

So if it ever expedient to ignore me, please do. I often comment quickly and then think all afternoon about your articles.