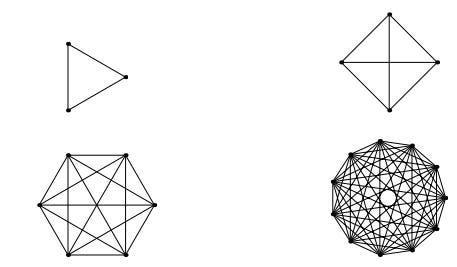

Metcalf's law states that the value of a [telecommunications] network is proportional to the square of the number of nodes (users) of the system. The basic relationship comes from the fact that the number of edges of a graph is in proportion to the square of the number of vertices/nodes.

If there are n nodes/vertices, then each one can "shake hands" with n-1 others. Each handshake is counted twice this way (once for each of the two nodes that "shake hands"), so the total number of handshakes (edges) of a graph with n nodes is n(n-1)/2, which grows asymptotically at the rate of the square of the number of nodes: n^2.

There is debate over the degree to which Metcalf's law applies to networks outside of telecommunications networks, where first applied. However, there is good reason to view the law economically, which is to say that it applies best to a monetary network. After all, Metcalf's law is a statement of value. It has been pointed out that the values of Facebook and Tencent obey Metcalf's law as they grow, and that Bitcoin's price trajectory has also.

A particularly salient observation about the application of Metcalf's law to Bitcoin is that the Bitcoin network aligns incentives, game theoretically. Holders of Bitcoin on the network are themselves partial (proportional) owners of the value of the network, so it behooves them to help improve the lives and health of everyone else on the planet---particularly the poor (and those who might at any point be poor)---because every person who elevates to a life with stored wealth increases the value of the Bitcoin network. If the number of long-term wealth holders doubles, the value of each Bitcoin quadruples.

Back in February, John Isige estimated 130 million holders (HODLers) of Bitcoin, worldwide. At maturity, there might be 15 times that many users. This implies a mature value of one Bitcoin (in a logarithmic range of) at $34,000 x 15^2 = $7,650,000. Multiplied by 21 million Bitcoins, this value does approximate a reasonable guess at the future total of "broad money", which is currently in the ballpark of $100 trillion in value. A deeper analysis could be more revealing, but that's hardly the point of this article.

The current state of the world is one of war: regional wars, forever wars, currency wars, and all manner of other wars. These wars cost the world trillions of dollars in value, not to mention loss of life and wastes of time. These conflicts are at least partially driven by the Triffin dilemma, which would cease to exist upon global Bitcoin adoption. Given the dampening rate of world GDP growth since the engineered mortgage bond crisis, such a reduction of costs might be counted as the greatest technological boost in modern history.

Now, here is what I would like for you to do: Imagine yourself to be a wealthy future Bitcoin holder with three whole Bitcoins worth over $20,000,000. You have a stake in the world, but obviously your own wealth and family matter most to you, so you hope to increase the value of your wealth. In the status quo, such wealth holders, not all of whom are wise enough to understand the damage they do both to others and themselves, invest in attacking others. This can happen through business, society, taxation that supports largely unnecessary militaries, and in seemingly innocuous ways like suboptimal zoning laws. A lot of people who aren't even sociopathic by nature go that route largely due to a misunderstanding of economic network effects. Now, let's pass through the Bitcoin portal to the other side...

Not so much in the networked Bitcoin world where Metcalf's law has become part of the standard economics curriculum. You understand that, at that moment, only a quarter of the people on planet Earth have long term wealth holdings [in the form of Bitcoin], so you look for some way to spend some of your money in such a way (education, medicine, pollution reduction technology, or any technology) so as to improve the wealth producing and retaining abilities of others who would then join the network. Because every time the number of people with wealth doubles, the value of your remaining Bitcoin quadruples. Perhaps you will spend some of your stack helping the lives of others.

And at the very least, you're less likely to spend it attacking others.

In case you're wondering---yes, Metcalf's law is certainly at work in today's currencies. However, the effects are dampened or reversed by the costs and tensions associated with the Triffin dilemma.

I hope this is helpful and hopeful to a lot of people. It was a pleasure to write.

All this to hide the true nature of money from the plebs and distract from a blatant ponzi type incentive scheme, of a so called inflationary / deflationary "currency" with almost no usefulness as actual money. But sure its going to be the next world currency. Once in place peace will breakout the world over. Empires will defund and dismantle all military. And no person will ever be greedy, cunning or vengeful ever again. You go btc!!!

Yeah. I love the observations and investigations into how we can change the systems so they favour good outcomes. I have no problem if workaholics get inordinately rich. I do have a problem when people connected to governments get rich off the labour of others without actually performing any labour besides paying backhanders.

Any system that raises the lowest level is a sign of an ethical society. Sure it reduces the availability of hungry and cheap labour to exploit but I see that as a good thing.