Why Student Loan Forgiveness is Theft that Fractures Society, and How Bitcoin Fixes That

The Bitcoin Wars Part XVII

Find other Bitcoin Wars articles here.

Unless you're one of the few people who has little regular contact with young adults, you've been hearing about the growing student loan debt for years now. Over the past generation, student loans represent the fastest growing piece of an explosive household debt burden that holds millions of American families back (and perhaps tens or hundreds of millions more around the world who pay more for education as a result).

1. We Have a Debt Problem

2. The Student Loan Debt Problem is More Corrosive Than Most

I'm going to skip the first contention. I'm sure there are some people out there who look in the mirror and do some sort of self-programming daily affirmation that Modern Monetary Theory (the economic theory that the chickens never come home to roost) absolves every sin of piling more straw onto the camel of burden. But I'm neither writing for the deluded, nor could such a task be contained in a single article. Honestly, I'm not entirely certain how anyone would handle that task, though the later parts of this article will certainly connect—for those patient enough to read.

Now, let's jump into the problematic nature of student loan debt. First, let us observe that student loan debt has been exploding over the past two decades.

This is part of how we get so many well-educated and well-employed 20-somethings still living with their parents (not necessarily unwise for everyone, but the circumstances seem out of equilibrium), not getting married or having kids, unable to afford a home. For a subset of these new older dependents, the reality of the American dream is warped. And that's part of the fuel fanning the culture wars.

This form of debt (student loans) is particularly corrosive for several reasons:

It increases the impact of demand for educational services, which pushes costs up further.

It decreases the incentive to educate children about finance prior to their entrance into the college system. Many have little understanding how to match the cost of their debt to the value of their degree to understand whether it's worth it. Different degrees have very different values.

Young people get trapped, with no room to sort out their emotional distress. It is hard to imagine this is not contributing to growing rates of anxiety, depression, and suicide among young people.

Student loan debt is rarely discharged in bankruptcy due to perverse policies that make current circumstances even harder to steer through (and giving the politicians full leverage over such policy as a vote buying scheme).

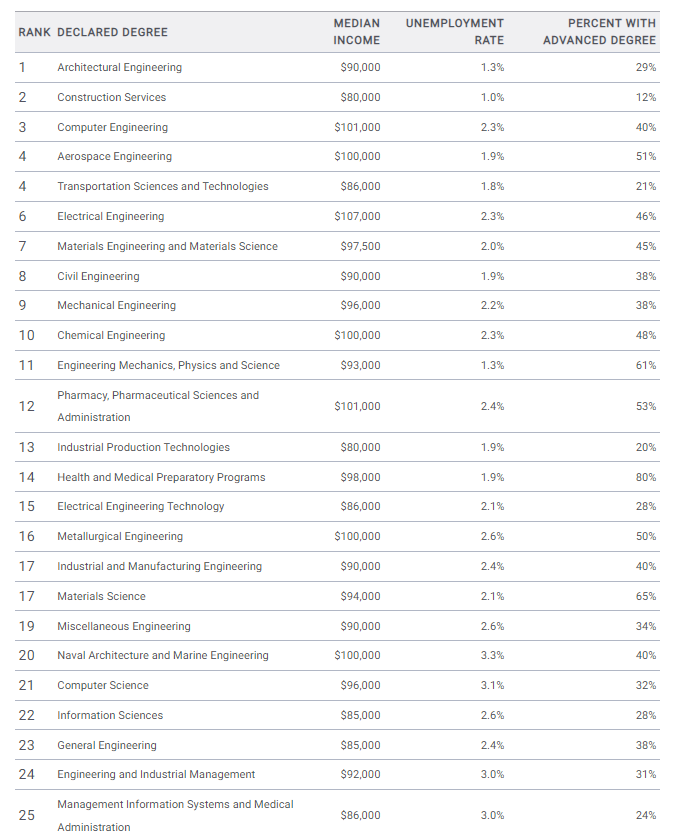

There are many lists such as the "Degrees Ranked" list below, and I take rankings with a grain of salt (I sometimes see Mathematics at or near the top, but here it is nowhere in the top 25?), but notice how computing and engineering dominate (with pharmaceutical and health programs doing quite well). STEM degrees simply do involve greater discipline, and this is part of why they're more involved in the most profitable sectors of economic development.

If you click the source link, you'll find that the pattern changes little through the top 50 undergraduate degrees. And the U.S. currently has a bit of a crisis among people who get "other than these" degrees, then have a hard time handling their debt. I see society fragmenting among Millennials (Generation Y) more than with prior generations, which was already bad. Now every educational path and personality type has a lifestyle (and an online support community) to match, and that doesn't help the icing of basic communication about even simple topics, much less complex political ones.

Worse yet, many of those students who graduate without marketable skills get sucked into jobs that are ultimately politically defined. These include many of the employed radical leftists, and from what I gather, they're often working "bullshit jobs" that allow for (or even tacitly require) time spent on organized political activity.

Once student debt became part of the cultural divide, it became an issue of "social justice" (by some definition), and then politicians could sell it as a "crisis". But if these loans were simply, "capital put to work for productive purposes," then the climb in student loan debt would be a technological marvel to celebrate in finance. So, to bring the issue into the political spotlight is already a matter of having one's cake and eating it, too. If there is one thing you can guarantee about culture war topics in the political arena, it's that talking about them plainly goes nowhere with anyone who isn't spending the time piecing together the financial education they should have been steered through as teenagers. That or they've found "meaning" in the political elements of their bullshit jobs, and conversation only threatens their artificial worldviews.

The Biden Student Loan Forgiveness Plan:

A Short Term Bribe and a Long Term Failure

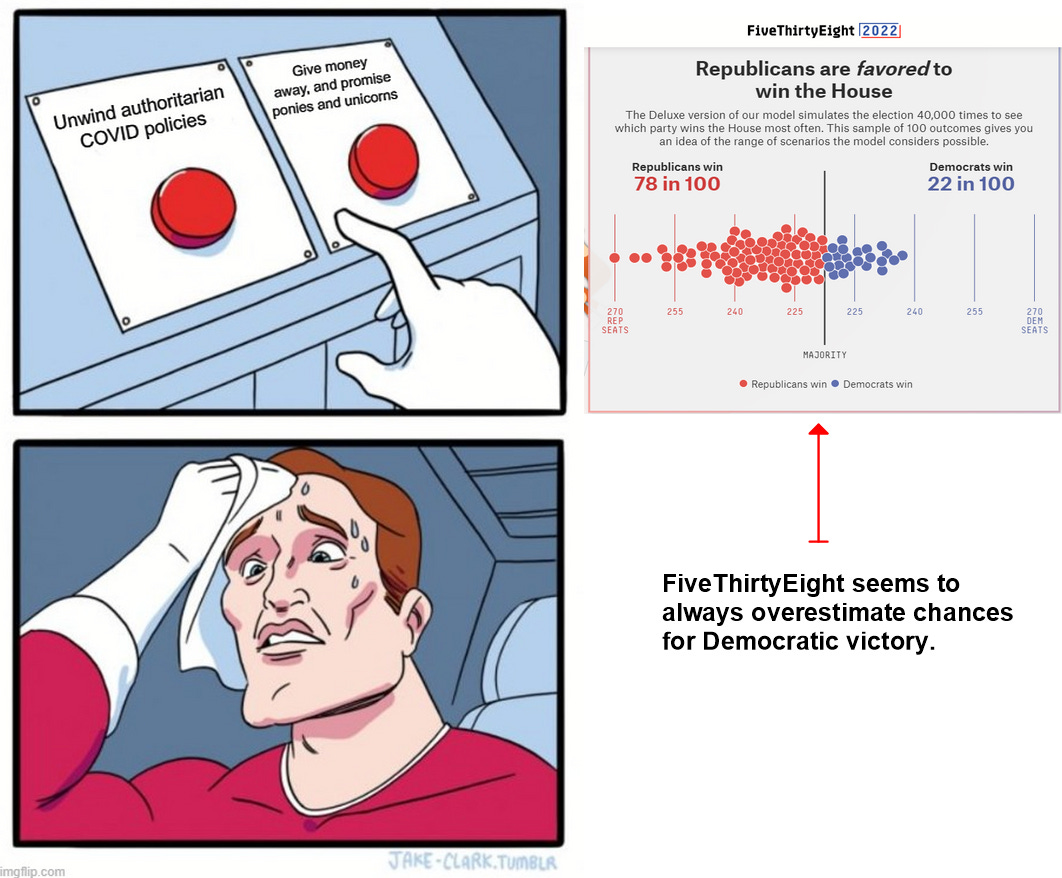

The obvious benefit of student loan repayment comes in the form of voters. The Democrats are getting murdered after 20 months of authoritarian pandemic management, and even though Trump steered the nation into Operation "Skip Necessary Steps of Scientific Validation" Warp Speed, and failed at containing the propaganda nightmare (if that was even his goal), the Democrats are the ones more overtly connected to the corporate machinery interfering with Constitutional governance, and mucking most everything up right now. That 95% of U.S. parents aren't giving poorly tested and propagandized vaccines to their toddlers is a telling sign. In order not to be obliterated in November, the Democrats need to run every play in their book—even the ones that directly contradict the messaging of all the other ones. (You think I'm kidding?)

There are pundits saying that taxpayers pay for the mistake of the student debt explosion. More educated pundits point out that the new dollars paying off that debt just get printed because taxpayers will never catch up with the debt. But does that lead to inflation?

Understand that inflation of the monetary supply occurs every time a loan is made. The debt gets rolled into bonds and held mostly by banks as reserves and investments, and are counted as part of the dollar supply. When the Fed sends dollars to banks (via POTUS/Congress/whatever mechanism), that's just a game of replacement as the debt vanishes. The inflationary process already took place. But the students no longer have a liability, so who really paid for it?

This is why I wrote the essay about the Cantillon Effect:

Call this "Modern Monetary Theory" if you like, but that's a fancy name to hide the fact that "corporate academic leftism" is really just the cleverly palatable new mask of Colonialism.

Now, consider what happens when student debt forgiveness becomes policy.

Academic institutions raise price (again).

Students take on even more debt.

The result is that an implicit or explicit negotiation takes place between corporations, universities, and students to further inflate student loan debt (and make the cost of college even higher). Meanwhile, this gets paid for by those Americans furthest from the center of the Cantillon network, foreign banks, and developing nations. This is the most regressive possible way to fund education, and it comes with the negative externality of fracturing society.

On top of all that, the added money sloshing around in the system baits the worst form of corporate gaming of the corrupted educational system in the form of fake students and arguably fake universities.

Meanwhile, the bribes that turn "forever debt slavery" into "modern corporate-academic indentured servitude" may seem like a step forward to young Woke minds without enough life experience to understand the full implications of their handshake with Moloch.

Now, you may be wondering all this time what Bitcoin has to do with any of this. We're about to get to that part…

How Bitcoin Fixes This

If Bitcoin, with its programmed supply ceiling, takes over as the global banking reserve currency, the federal government can no longer continue deficit spending. That's the end of Cantillon effect-fueled modern banking slavery. It's also the end of easy profits for bullshit jobs in the U.S.

What will they cut?

I suspect nearly everything in the federal budget gets cut because the markets will determine that the vast majority of federal spending does not yield a return. Some of those functions will be taken up by private entities (where healthy competition to problem solve can be reignited) and local governments (I suspect we will see more variants of Utah's version of the social safety net).

But hypothetically speaking, somebody with the money/Bitcoin, whether connected in any way to the government or not, could fund student education by grants or loans. It is likely that this will take place in a limited way. However, the best news is that pulling back all of the excess money inserted into the system will result in the price of a college education crashing back down to Earth. Students may once again understand the Boomer generation's ability to work a part time job, a summer job, and manage to navigate through college all at once (with a mentally healthy outlook on life).

The incentive to miseducate students on a financial level will disappear with the disappearance of the feedback loop that uses students to steal money from foreign banking networks.

There are additional benefits even prior to college journey that everyone (worldwide) may enjoy. I describe a major one here:

With aligned incentives, we may see the true value of the Montessori philosophy put into action. The results: greater participation in the expansion of technological development and deployment, plus lower costs of handling social problems such as crime and mental illness. The value cascades and then cascades again.

Finally—and perhaps just in time to limit further damage ignited by the insane policies of the plandemonium—the machinery that spits out agitated culture warriors gets cut out of the educational system like the tumor that it represents. And if making American "great again" should mean anything, it should mean restoring natural incentives and sane policy to this land of otherwise (mostly) great people.

i had an employee once who had a master's degree in some gender grievance studies thing, although i didn't know this at the time. apparently she did her paper on the oppressiveness of lipstick and i guess no one at estee lauder or revlon thought she was a good fit so she ended up doing classic women's work- sewing in my theatrical costume shop. i paid people fine but certainly not enough to service the debt on a completely useless ivy league master's.

one day she went to lunch with two of my young gals and when i got back from lunch, she was busy packing her stuff and accusing everyone in the shop of being racists! now, i ran a congenial family style business where everyone got along and i played peacemaker when they didn't. my employees were all women and homosexual men, as you'd expect and we had people from poland, russia, brazil, croatia, china, etc. it was a kind of united nations and many of the women had left totalitarian countries and were grateful for the freedom of the USA. suddenly hearing them being attacked as racists by a co-worker was beyond the pale.

i told her she could not talk to my good people like that and she insisted that she couldn't work with racists so i invited her to take her things and go.

after she left, the girls she had gone to lunch with explained what had happened. one of the gals- chris- was pretty curvy and she had been accosted by a homeless guy of hispanic origin on the way back from lunch. something like "hey chickie, nice tits"- the usual come on line that no woman can resist from a man who hasn't showered in a month!

chris took it with good humor and said to her companions "look, my new husband." that was it.

my master's degree in lipstick employee was also "latinX" (which wasn’t even a thing at the time) and took this as a slur against hispanic maleness.

notice that she didn't side with her abused "sister" as you might have expected an ivy league feminist to do. i call this "When Wokes Collide." which disenfranchised minority wins the mantle of victimhood today?

imagine my surprise when the next morning, she was sitting at her sewing machine as if nothing had happened and the room was pin drop quiet! i called her into the front fitting room.

"what happened?" i asked. "did you suddenly realize that your landlord wouldn't accept the old 'i can't work with racists' excuse for why you couldn't pay your rent? did it suddenly occur to you that unemployment wouldn't let you collect when you wrote down that you had plenty of work but just couldn't be around racists? no, no, you were very clear about your principles; you can't come back."

she cried and said i couldn't possibly understand. "what is it with you people? i'm a greek italian american woman who was ridiculed in grade school because i wore glasses and sucked in gym class! why do you all always think you have a stranglehold on suffering?"

she showed me a multi page gangsta rap ad for clothing in a fashion magazine. "look at the kind of offensive things your employees bring into work!" she said, missing the irony that it was HER magazine.

i thought the ad was pretty brilliant and said so. i also pointed out that all the black models who appeared on those pages said YES when their agents called about the job and they all cashed the checks. if they weren't offended, why should i be?

but more to the point, did she really expect me to stand at the door and rifle through everyone's bags and thumb through their reading material to make sure that there was nothing that might upset anyone? because i don't want to work in or own a place like that. i never saw her again and when her unemployment claim came in the mail, i rejected it.

i think about her often these days because her ilk seem to have infiltrated everywhere. i'm sure she is still paying off her useless and expensive degree with whatever menial work she can get. i would resent it bitterly if i am required to pay off her debt.

transferring student debt onto the tax payers without first cutting out the rot in universities is criminal. get rid of the $400,000 a year diversity deans, put all the "safe spaces" to good use, bring the tuition down to whatever i paid in 1972 adjusted for inflation.

universities now have become criminal organizations, copying the medical industrial complex model. we don't need any gender specialists; we need farmers and people who can do things with their hands. parents need to stop seeing college as an essential extension of childhood. take the money and have your kids learn a trade so they can make their way in the world. especially don't send your young adult children to any college that requires them to be vaccinated and boosted. right out of the gate, that's the wrong lesson.

the only way to stop this is to starve the beast. these places have endowments on which they should be able to run forever. don't give them a penny more!

The common arguments for & against loan forgiveness usually both overlook the ROOT CAUSE which is in the fact that most of these students should never have had to pay that much for the education to begin with and those who benefit from the loans are everyone but the students, generally speaking. This is one of the best summaries of the corrupt system: https://www.rollingstone.com/politics/politics-features/the-great-college-loan-swindle-124484/

In a nutshell:

- Student Loan bankruptcy protections were all but completely eliminated by 1998 fostering the drive to lend more and more *at interest of course (https://www.savingforcollege.com/article/history-of-student-loans-bankruptcy-discharge)

- Tuitions then increased dramatically, thereby “requiring” more student aid AKA loans. This is even more pronounced at private colleges which increased tuitions offset the Fed aid/grants (https://www.vox.com/policy-and-politics/2015/8/12/9130157/financial-aid-tuition-bennett-hypothesis)

- Dept of Ed, lending institutions and school admins all rake in on the arrangement

It’s the usual culprits fueled by greed and selfishness. Disappearing the debt is simply a band-aid. What needs disappearing is the gov/banker lending scheme.