Find other Bitcoin Wars articles here.

Now that I've expanded my Bitcoin education chat group, I plan to write more about Bitcoin. Tuesday's Rounding the Earth Roundtable will also feature a Bitcoin/cryptocurrency discussion for the first time.

For the purpose of this article, let us dispense with the challenges that Bitcoin faces in ascending to become the world's reserve currency, meaning that the Bitcoin network would become the world banking system. Here, we evaluate the future in which we no longer price Bitcoin in terms of dollars or other fiat currencies, which may not even exist. Bitcoin would simply be the unit of account. However, we might still make a basic monetary comparison and suggest that the value of a single Bitcoin might be around $10 million in today's dollars. Let us not quibble about the total monetary supply or how it might be sucked up into Bitcoin during hyperbitcoinization, topics which I hope to discuss in future articles, but essentially this valuation would imply something like a monetary supply of $170 trillion globally (assuming that roughly 4 million or so Bitcoin are simply lost at that time due to loss of passwords).

Again, let's quibble later about these starting assumptions. I plan to discuss them more thoroughly in other articles.

Does the Monetary Unit of Account Accrue in Value?

Yes.

This answer probably feels weird to many people who tend to think of fundamental units that seem based in almost mystical invariance. I will do my best to explain this simply.

If you are entirely or generally unfamiliar with the notion of the unit of account, this set of pages at thebusinessprofessor.com seems to be fairly thorough at first glance.

In economics, money behaves as part of the system, and gets warped along with economic changes. But just as space-time warps around gravitational objects, we can and do generally observe variation in units. The medium in which a unit functions is important in understanding the type and scale of those changes, and the medium of economics is quite dynamic.

Along the way to Bitcoin's ascension to the world monetary throne, the greatest annualized returns (increases in Bitcoin's value) would have happened (have already happened) throughout the process. But once on the throne, Bitcoin will continue to accrue value based on the supply-and-demand forces for monetary capital (with respect to all other objects and investments). One year a Bitcoin might buy 400 acres in some geographical location, and then 406 acres the next.

What might influence that equilibrium most?

This is the question. The strongest influence will come from the technological growth factor of the global economy.

The relationship may not be perfect. Nobel Prize winner and MIT Economist Robert Solow estimated that 90% of economic growth came from technological innovation in the U.S., which was by far the world's leader in research during that era. The global factor may be closer to 95%, perhaps.

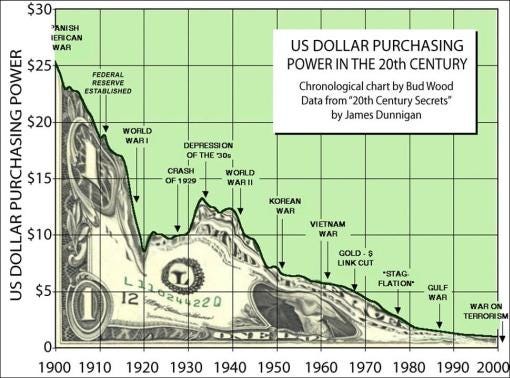

Thus, the growth of the value of a Bitcoin should basically mirror the totality of human progress. It's hard to know what that is as a percentage given the way inflation (including shadow inflation) of the dollar supply sucked a great deal of those gains into centralized wealth pools whose jobs became protecting those centralized wealth pools. The fact that GDP growth is a flawed proxy for utility growth makes the problem worse. Economists have debated the percentage growth rates since the dawn of…the times since economics have been debated. What will the actual growth rate look like?

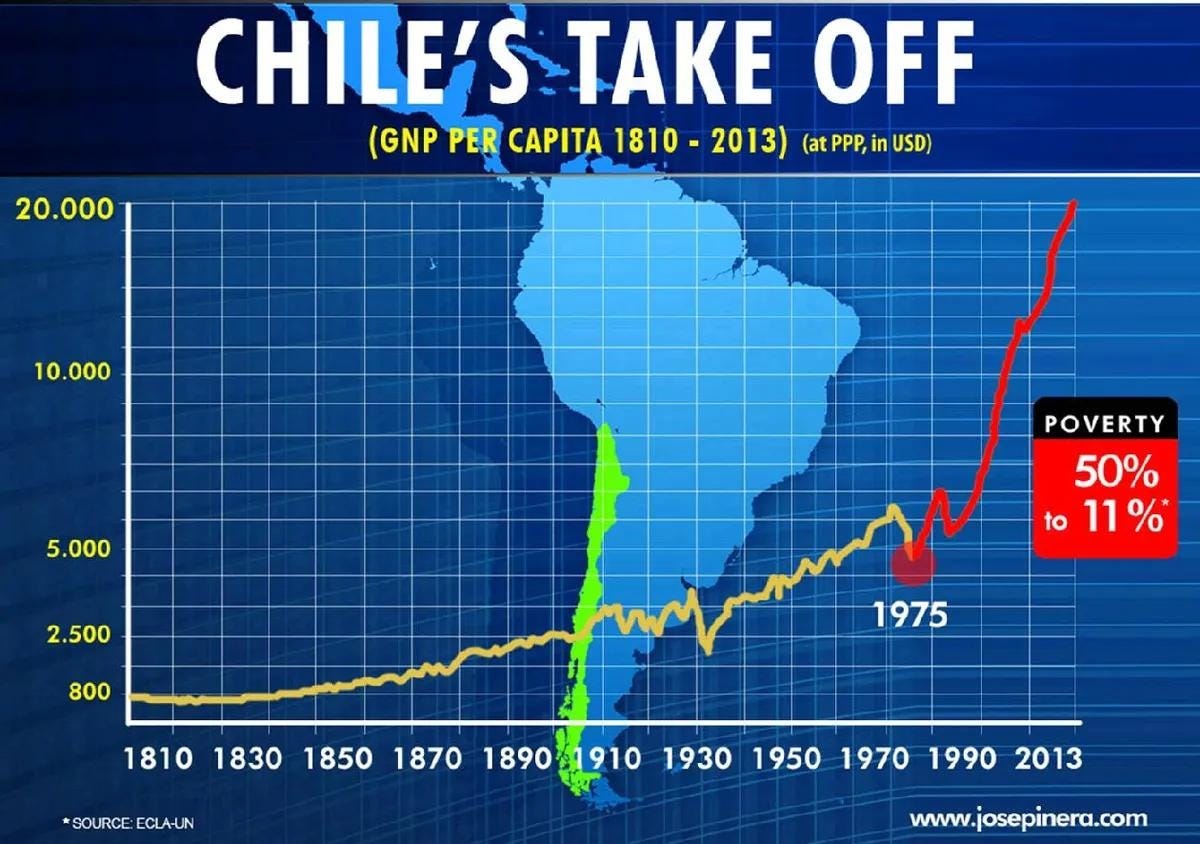

I'm personally less concerned about what the true number for the economic growth rate might be than that essentially all the people of the world have access to the gains because I think that artificially extreme and systemic inequality is something like an anti-technology. But for the moment, I'm going to pick a number like 2% for the sake of discussion. Sure, GDP growth appeared to be more like 4-5% for much of the twentieth century, but the measurement may include various forms of warping, including what might be incorrect interpretations of inflationary effects of the monetary supply. We should also assume that there are times when growth "plays catchup" back to an exponential growth curve. One example that always comes to mind for me is the "Chilean Miracle", though on a global level, the conclusion of the world wars might be the most significant warping of twentieth century economics.

In an era of zero (or near-zero and predictable) monetary supply, we should expect to see price deflation for ordinary goods and services. If one year a can of kidney beans costs 10 satoshis, then it might cost only 9 satoshis five years later if and when technologies of automation make cans of beans easier to produce. It might also be the case that the quality of the beans improves and that we pay 10 satoshis for superior beans for which we would otherwise have paid a little bit more. This kind of price deflation does sometimes happen during our current era, but most often inflation of the monetary supply inflation eats away the technological gains as the value of our dollars shrinks that we would otherwise see in improved grocery bills.

A Note About Bitcoin Mining Economics

One implication of the accrual in value of a single Bitcoin is that, assuming miner fees remain invariant in terms of Bitcoin awarded in the mining lottery, that the growth in capital accrued by miners also grows in proportion with the growth in value of the capital. I will talk further about this in a future article where I will refute the notion that block reward halvening threatens the Bitcoin security model.

I would love to see the derivative of the two curves in the GDP figure. They might tell us a lot about the functioning/non-functioning of the rule of law and protection of property rights in the world as a whole. There's no reason to think that growth in GDP would be constant as it seems to be in the chart from 1950-present. Knowledge/technology/productivity should follow some sort of exponential curve, as delta-knowledge is based on existing current knowledge. It's clear that massive inflation and government controls in the first world, and lack of rule of law in the rest of the world is massively holding back world economic growth, because think of how bad this chart would be with China excluded.

20 years to hit 10 Million equivalent? How much disruption/global panic/ governmental crisis creation/distraction along the way? The era of the military petro dollar (combating Russia and China, but also influencing Latin America, south east Asia, and to a lesser degree Sub Saharan African countries…. ) has been so immense on our frame of reality, not sure we can fully grok what comes next. I’m fully in favor of the end of these governmental mafias, hegemonies…. While also hoping we don’t enter an era of warlords…. Public infrastructure will continue to be a need for the vast majority of families, and elderly…. Hospitals, roads, water for kids . Perhaps beyond a “Green New Deal”, we can have a “Bitcoin New Deal”…. To advance investment in meaningful futures and experiments…