Why You Probably Shouldn't Trade Cryptocurrency - Another Kirsch Capital Story

The Bitcoin Wars Part 25

Find other Bitcoin Wars articles here. Find more discussion at the RTE Locals community.

During 2018, I worked on a book on how to successfully trade cryptocurrency. With the book around halfway complete, I abandoned the project for multiple reasons:

It is desperately irresponsible for most people to trade.

It is desperately irresponsible for most people who think they can trade to trade.

If "success" is measured versus just holding Bitcoin, the game is tougher.

I stopped trading myself. I pulled out just before Crypto Winter saw a dramatic collapse in volume. That made it harder to imagine that I wouldn't be leading readers into doing something desperately irresponsible, despite my "do not try this at home” warnings.

I have talked a bit about trading in one previous article.

https://roundingtheearth.substack.com/p/everything-in-high-finance-is-conspiracy

I haven't chatted with Steve Kirsch in a few weeks, but he said some things the last time we chatted that need answering or explaining.

I don't usually talk trash, but there are times when it sends the right signal. In particular, Steve seems to be heading toward Disasterland, and if somebody can encourage him to find a bit of humility about subject matter that he isn't particularly experienced with, that could save him and many other people millions of dollars. You can (re)visit my warnings from February here:

https://roundingtheearth.substack.com/p/kirsch-capital-equities-fund-buyer-ef8

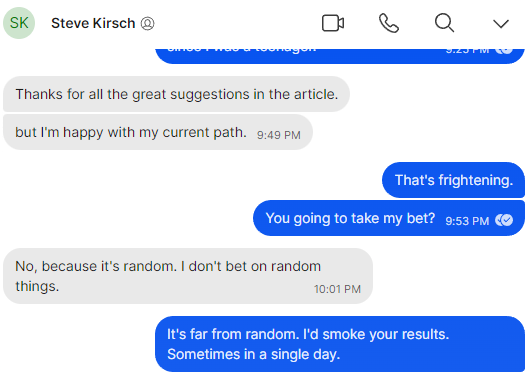

It is astonishing that Steve would claim that his fund returns versus my trading would be a random bet. This indicates a fundamental lack of understanding of markets. Were results random, hedge funds would hire from the world's cheapest labor markets. Mostly, they hire from just a small handful of universities.

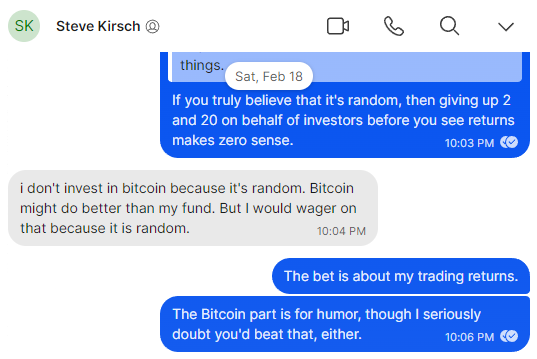

Even worse is that if Steve's "randomness" proposition is correct, then a "fund of funds" should not ever exist because giving up an additional "2 and 20" would lose to throwing darts at board, or seeing which square on a field a dog poops on.

But just for kicks, I'll improve my offer of a wager to 2:1 odds, meaning that I'll bet my own $50,000 vs. his $25,000. At whatever date his fund starts, I'll start a trading account, and trade for the remainder of the year. Actually, I'll probably just trade one day a month because I have too much to do, but I'm still happy to lay long odds this way.

Now, note the date on the next part of the exchange: February 18.

Investing in Bitcoin…random?

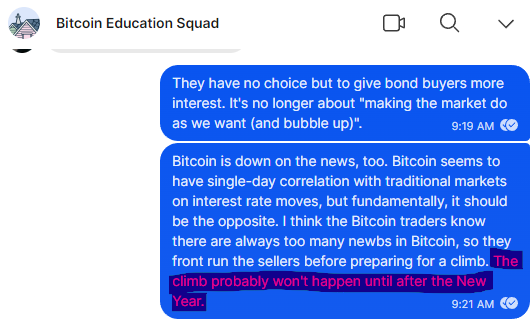

Here is some commentary I made in October of last year in a group I run with 200+ people in it.

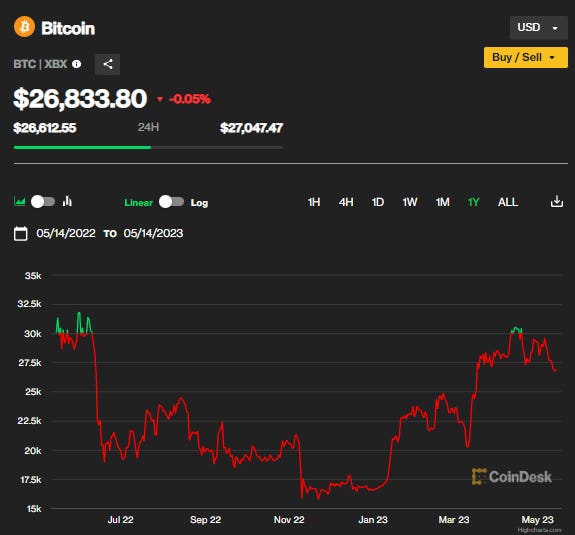

Every once in a while, I share the thought (for those new to the Bitcoin space) that mid-cycle lulls should not be expected to bloom into bull runs until after the tax calendar turns. Let's see how that's going.

From the time I made that statement in October to the New Year, Bitcoin's price dropped 15%. Since then, it rose 60%.

Maybe there is something to the idea that volume health returns in the middle of Bitcoin's four-year (halvening) cycle after tax season ends?

Probably just random…

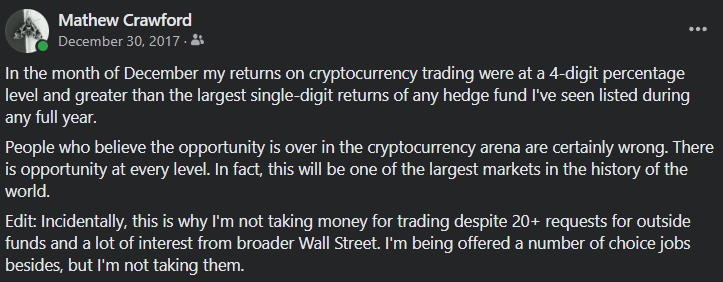

This next part gets particularly interesting. Apologies for the self-bragging, but the fact of the matter is that trading is the game where results are all that matter. It's also a game space in which bravado becomes similarly silly as it might be during a rousing game of beer pong.

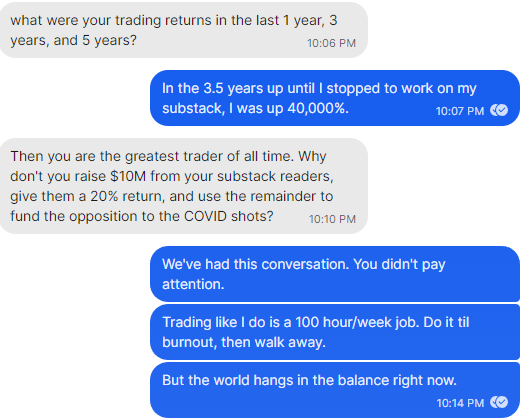

Steve seems to doubt my trading returns, though in 2021 he asked me if I wanted to run his hedge fund after hearing about my experience trading—I've shared some of my results with him via email. But now he seems to doubt my results after I've publicly critiqued his fund plans, and his understanding of trading (particularly in the cryptocurrency markets).

But since I've been challenged, I'm going to share my trading results below the paywall.

Steve is a more status-driven person than I am. In fact, half my jobs on Wall Street were doomed to end in me walking away simply because the environment was slow and boring, or there just wasn't a good reason to get out of sweatpants and skip the baseball game down the street (I lived in Wrigleyville for a spell). Most people in trading jobs jump through hoops to impress. That just doesn't interest me.

Twenty years ago I flew into Manhattan and interviewed with Ralph Reynolds, the head of Deutsche Bank's Global Derivatives Trading team. He had his economist, a trader, and a quant interview. He then asked me which job I wanted. I thought about moving back to Manhattan, but in the end decided that I'd rather make less money trading for myself, and spend more time with my wife (then girlfriend), or else do something more exciting with my time.

I flew home and never called him back.

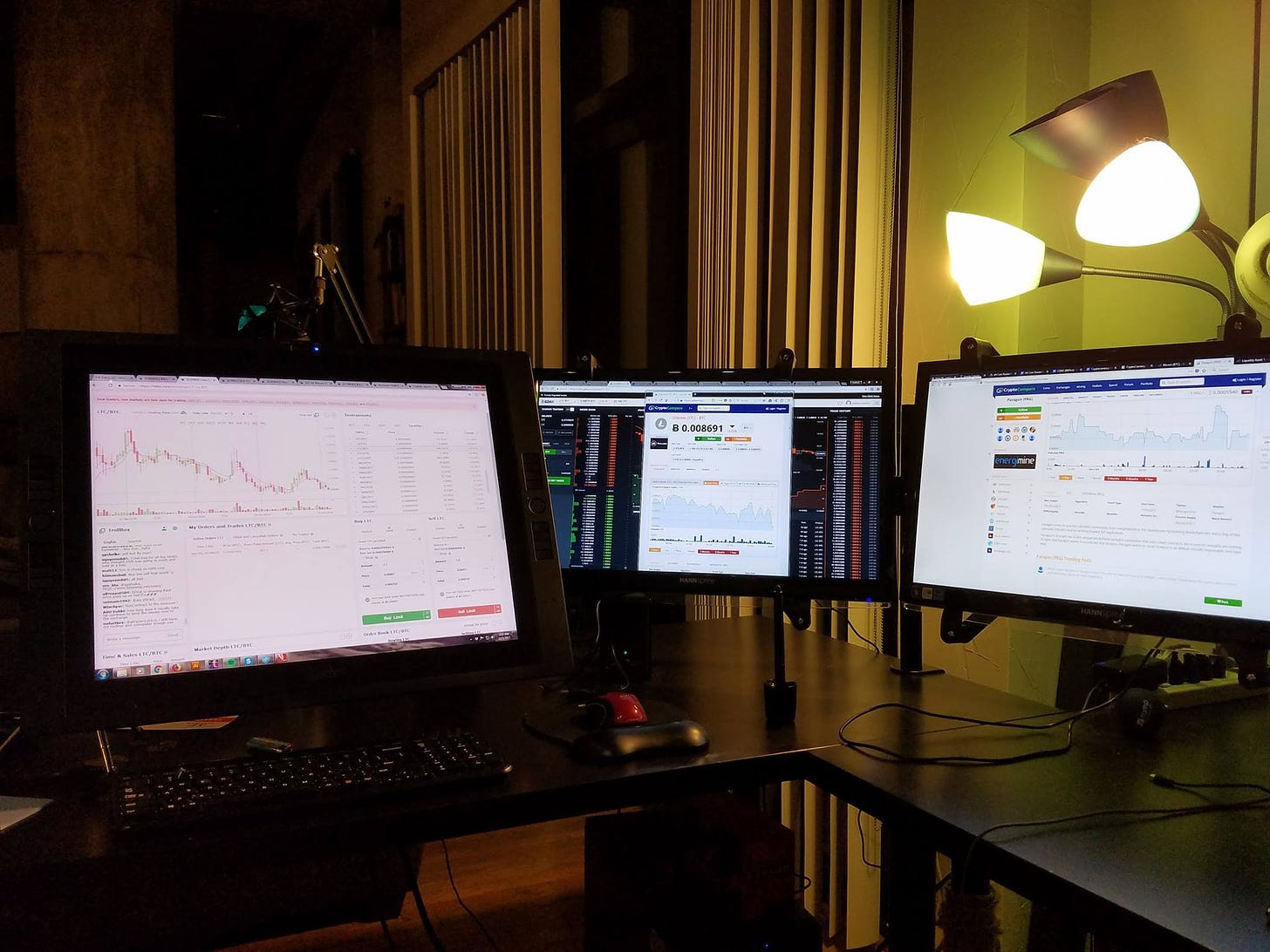

Here is the way my trading reports read from the time I began one of my trading accounts in 2017: