Why Would Silicon Valley be Ground Zero for Banking Centralization? Part 1

The Monetary Wars: Part 16

Check here for other articles on the Monetary Wars.

Consider this perhaps one step into Part 3 of the "Nuclear Debt Theft, Nuclear Monetary Supply, and Nicki Manaj" series (Part 1, Part 2).

In mid-2000, after I'd quit my second hedge fund job, and proved to myself that I could do better from my computer at home, I started writing articles on what was the newfangled blogging site of the day: LiveJournal. The most common theme of my articles was, "We are heading into the Great Financial Collapse [in our lifetimes]" and more specifically at the time, "Um, this thing about the Fed tacking free insurance on top of rolled up subprime mortgage bonds, deforming the complex plane of debt markets, isn't going to end well."

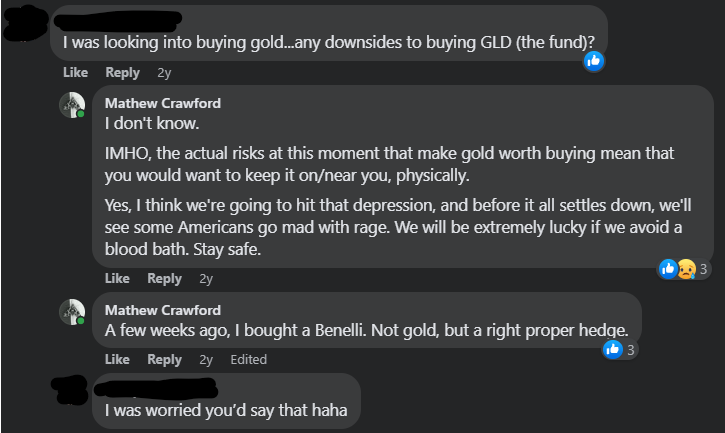

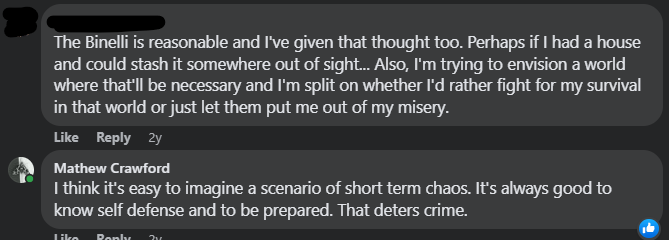

Fast forward to early 2020. In the wake of the repo market collapse (Sept 17, 2019) and the outset of nuclear absurdity that is the declared pandemic, I'm telling my friends to start preparing for a serious financial event.

If you're not aware, do a few minutes of internet research and you'll find that nations, including Texas, and large institutions have been repatriating significant quantities of gold. This has been going on for the past several years. As I've previously written about, it was predicted in Pentagon financial war games in around 2008 that Russia would dump treasuries and buy gold. That took place in 2018. But even before that, Texas set up its old bullion depository. Those are just a couple of stories you'll find poking around the internet. And when the game of bullion banks overprinting paper gold comes to an end (yes, the gold market is also in a fractional reserve state), we should fully expect the price of gold to explode barring some unexpected counterforce (like an asteroid eliminating civilization, or UFOs landing to dump gold in order to take on precious bovine cargo).

More specifically, I said, "Actual, physical gold, not paper gold. Also a shotgun and shells."

Let's talk about that Benelli shotgun, briefly…

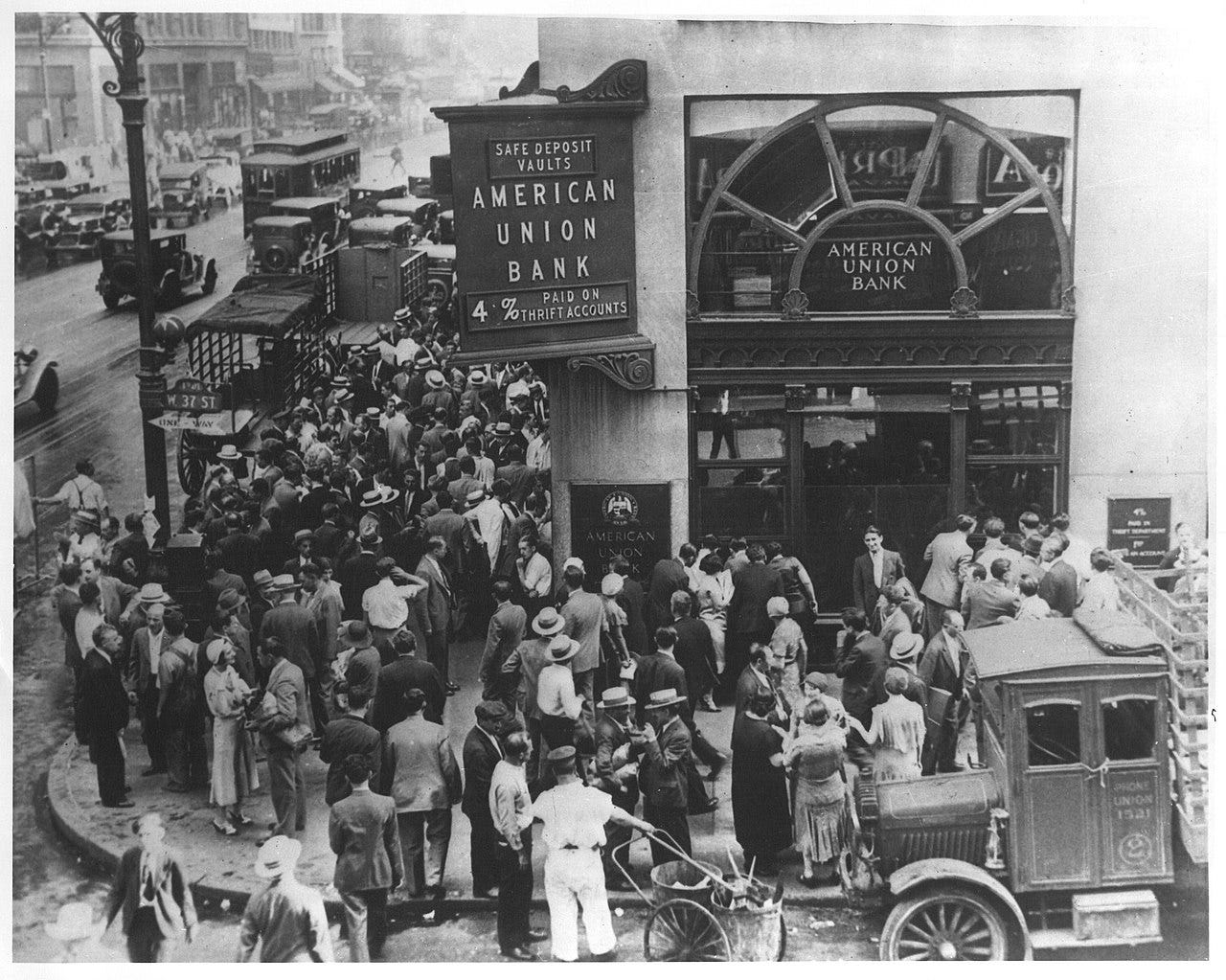

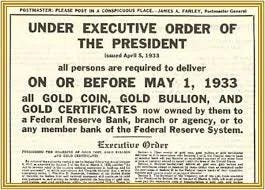

To be clear, I expect for there to be some short term chaos and fear. Recall the episodes of the Great Depression. I could dig deep, but superficial is fine to make the point. In 1929, U.S. stock markets crashed. Over four years, the unemployment rate quadrupled. A lot of folks in the up-and-coming economic hegemon saw hard times for years. There are still a handful of people around such as my grandmother-in-law who walked with a bucket for a mile to get water. To them, dust was ubiquitous. In 1933, the federal government "solved" the nation's problems by taking everyone's gold.

Then "poof" came the recover with the printing of easy money. That was all one giant theft scheme, of course. Just as we're in a global civil economic war, the two World Wars of the first half of the 20th century were also just that: Plandemonium—exogenous shocks that the oligarchs can use to obtain control over the upcoming new era. And just as the sterling fell from its perch a few years later, the dollar will be unseated sooner than later.

This isn't 1933, but we should be careful. From 1930 to 1933, the murder rate in the U.S. did climb. But it nowhere near doubled or anything like that. Similarly, from 2020 through now, the murder rate has climbed, but we're still in the ballpark of what things looked like in the early 30s. And when it comes to the U.S. murder rate, there are two zones: inside the ghetto, and outside of the ghetto. It is still the case that the lion's share of violent crime comes from fatherless males crammed mostly into the handful of poorest neighborhoods in the U.S.

Here in Texas, 31 million of the 30 million residents are armed, so the violence won't leak very far in any dramatic way (yes, highly distributed guns mean more violence during peacetime, but they mean a whole lot less of it during a crisis, which is part of the point).

What has skyrocketed much more than violence over the past few years is the ability for media of all sorts to be used as tools to make people fearful and anxious. I'll come back to that…

Fast forward to May 2022. I'm on the phone with Steve Kirsch, telling him that we're about to enter some form of financial collapse. He asks, "When do you think that will happen?" My reply was (maybe word-for-word), "I think there is a 70% chance that will happen in the next year."

I guess I wasn't particularly convincing since Steve is out raising $100 million for a fund of funds.

Yes, I think we're headed into a financial collapse. And I felt from the start of the Plandemonium that this was the case. I said so in the first interview I did in early 2021 (now scrubbed from YouBoob). In so many words, "Vaccine profits are dwarfed by the game surrounding the dollar/Triffin dilemma/reserve currency."

No, I don't think it's the end of the world. I believe that we (the U.S. and close sphere) will recover. But this will take some explaining, and it's not bad to have some food, seeds, water, ammo, and coins made out of precious metals in the short run. It's definitely not bad to be wide in your investment perspective just now. It's also good to have a skill set that still functions when the banking system doesn't.

Liability Time Bombs in the Monetary System

As is usually the case, I'm writing an article I'd love to spend a week on in three hours, starting after midnight. I've also been busy establishing a new business after spending around 10,000 hours over the past three years focused on the Plandemonium, so I haven't made the phone calls that I would usually make to write the most complete form of this article. Assume that there is plenty more to the story (which would be true even if I wrote 50 pages).

All that said, there is plenty that is not being discussed about the current banking crisis that we can talk about.

First, let us consider what's going on with interest rates.

If you're still not sure that what we're going through is the result of careful planning, understand that the evidence I've laid out is a tiny fraction of what I've got in my notes. In particular, match the nosedive of 10 year treasury rates with the mass exodus of top corporate CEOs.

Unlike 2002 and 2008, the "Great CEO Exodus of 2019" did not follow an earth-shattering event such as the 9/11 calamity or the mortgage bond market collapse. Instead, the CEO exodus that began in mid-2018 took place ahead of the announced emergence of COVID-19.

Huh.

And the exodus was not just in the U.S. Saudi chief executives stepped down at a faster pace, too. That's quite interesting given the very real possibility that the Global Civil World War E we find ourselves in may very well have begun among the Saudis in Las Vegas.

Now, I'm going to share some whispers that I cannot corroborate, but I can follow it up with some hard data. During 2020, I heard that activist groups were actively teaching lower income class Americans how to (1) safely dodge paying rent (during the eviction moratorium), and (2) how they could buy brand new cars and never make a payment.

"How can people get away with not making their car payments?"

Thank you, mysterious voice for nearly always being there to ask the right question. Ordinarily, finance companies would repossess vehicles whose owners go delinquent on payments. However, with interest rates rising in 2021 and 2022, the dollar values of most assets (used cars included) were in decline. Repossessing a car and selling it at auction would put a loss on the books. So many losses at once would sink finance companies, so they almost universally kicked that can down the road. Even articles like this one describing the problem are undercounting the number of severely delinquent loans, which I'm told may be several times higher than officially counted.

There is also the problem of home builders and those who finance them falling apart amidst the whiplash of the markets.

So, even before we get to talking about the banking sector, we see the possibility of finance companies collapsing, and credit getting tighter dovetailing with explosive interest rates that are deforming the complex plane of financial economics.

Fear and Loathing in the Supply Chains

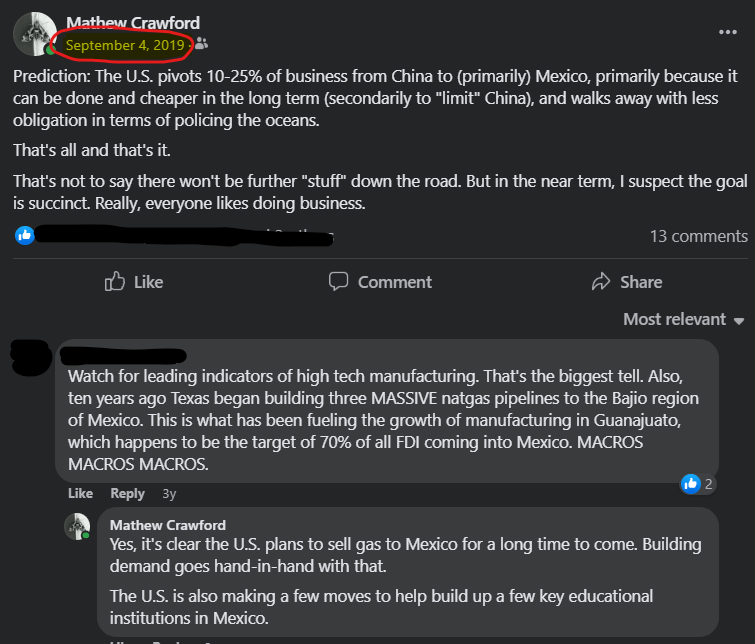

While the mainstream media doesn't cover it, U.S. capital has been preparing pivots from China to Southeast Asia and Mexico for more than a decade. But that's a gradual process.

The supply lines between the U.S. and China are breaking down, and that's been a known quantity for several years, though it was only really advertised in niche propaganda. But no, this didn't all begin with President Joe "I can fit my clenched fist in my mouth" Biden.

The U.S. has spent years moving "manufacturing outpost productivity" to Southeast Asia and Mexico. These moves certainly predate the last election, but propagandists are going to propagandize. What can you do?

It looks like I couldn't finish all this before needing some sleep, so there will be a Part 2, hopefully tomorrow.

Update: Part 2 is now available.

So this is all being planned as the mechanism to introduce CBDCs?

Exciting times coming. May it be the kunlangeta who suffers the most. [This posted double when I first commented; then when I deleted one, the other was deleted too. So this time I'm leaving it up.]