Other articles in the Monetary Wars series can be found here.

At this point, you've probably seen many such headlines with a variety of narrative thrusts behind them. If you are not a financial insider, well up the chain, somebody has probably used your analytics to figure out how to best propagandize you as to what exactly is taking place.

No, I don't know enough to fix all that. But I do know some things that can help [some people] better understand the situation.

What's This About an Oily Dollar?

Wikipedia is often a great place to start, but a poor place to trust in totality the closer a topic gets to power. Recall Mathew's Law:

The more political the topic, the less reliable is Wikipedia.

Usually, Wikipedia gets the basics right. It's easier to run propaganda over a topic where most everyone agrees on the basics. From the Wikipedia article on petrocurrency:

All this really means is that nations that make money from oil spend it abroad using the currencies that are most easily spent abroad. In a world in which a global reserve currency soaks up the lion's share of the money in the banking system, those profits are more easily spent in the form of the reserve currency, which would be the U.S. dollar. Thus oil is most often (but not always) traded in U.S. dollars.

It's about that simple. But as the petrodollar recycling article on Wikipedia correctly explains, not all global oil trades in dollars.

The dollar (or other currency) runs in a feedback loop between the oil exporters and the rest of the world from which it buys cars, toaster ovens, megayachts, Western construction engineering for mass scale projects around Riyadh, race cars, drugs, expensive art, stocks, Time Magazine, and women. Then the dollars are spent on oil again. Rinse, and repeat.

Also weapons. Lots and lots of modern, high tech weapons. Billions of dollars more in training to operate all those modern weapons. Weapons represent the largest portion of the House of Saud's dollar spending.

The reality is all a bit more complex than this, of course, but I'm limited both in background knowledge and keyboard time.

Once upon a time the House of Saud had been reduced to twenty dudes led by a tenacious Abdulazziz bin Abdul Rahman Al Saud (King Abdul-Aziz) riding back into their ancestral homelands from Kuwait where the family might otherwise have simply assimilated and moved on as part of the local culture. Twenty dudes riding camels politicked and otherwise struggled in that deep desert (where there were ZERO rivers through a MILLION square miles of land) to re-establish the House of Saud on par with the Wahhabists after struggles with various factions pushed the House of Saud out. The power vacuum left by the vacated Ottoman Empire made the world's leanest invasion, led by King Abdul-Aziz, possible.

Then King Abdul-Aziz consolidated power by marrying into basically every powerful family on the map. Kingdom Saudi Arabia was effectively established by a massive harem producing scores of offspring. King Abdul-Aziz was a busy man even before the massive oil economy developed in the Arabian Peninsula.

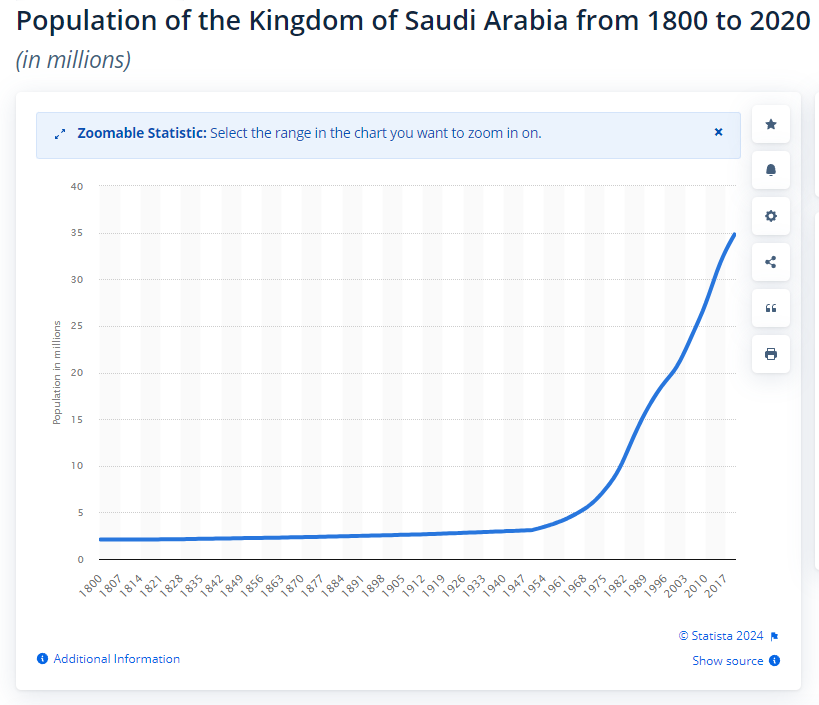

We are talking about a harsh land on which barely two million people lived a century ago. The willpower of twenty dudes on camels was effective in deep desert land with an average population density of two people (one penis, no guns, and few swords) per square mile. That's not to downplay the feat accomplished by the late King Abdul-Aziz. I'm just setting up a story of an age before oil before the Sunni-Shia Islamic divide had blossomed into millions and millions of armed men representing dozens of factions, all eager to control all that oil [and associated convenience appliances, race cars, and women]. Desert power has evolved.

These days there are dozens of armed factions vying for power in the Middle East…yeah, you get the idea. And you might even wonder if the arms dealers actively encouraged the process (with the help of tax-payer funded propagandists). Does the U.S. covertly encourage Iran to fund cheap Houthi combatants that cost the Saudis orders of magnitude more to defend against? Who really funds terrorism more than any other nation?

Saudi Arabia is surrounded by enemies, so there are a lot of ways to put pressure on them.

What were the Forever Wars about again…?

Did the Petrodollar Just "End"?

Not. Bloody. Likely.

But there is currently an effective propaganda campaign to direct your worries in this direction. This will take some time to pick apart.

As the video above explains from the outset, Saudi Arabia's economy—despite great pains taken by leadership over the past two decades to re-engineer it—is still a one trick pony.

Note that Forbes rates as stronger the currencies of all the other oil rich nations around Saudi Arabia as among the "strongest" currencies in the current environment.

But Saudi Aramco is [by far] the world's most profitable corporation. And if I understand the situation correctly, 98% of that stock is held by the House of Saud. Saudi Aramco "went public" by selling 2% of shares, marking the world's largest oil reserve to market, and perhaps beginning the globalist/corporatization of Kingdom Saudi Arabia (KSA). Perhaps this is also why the House of Saud recently began to bend toward the anthropogenic global warming narrative?

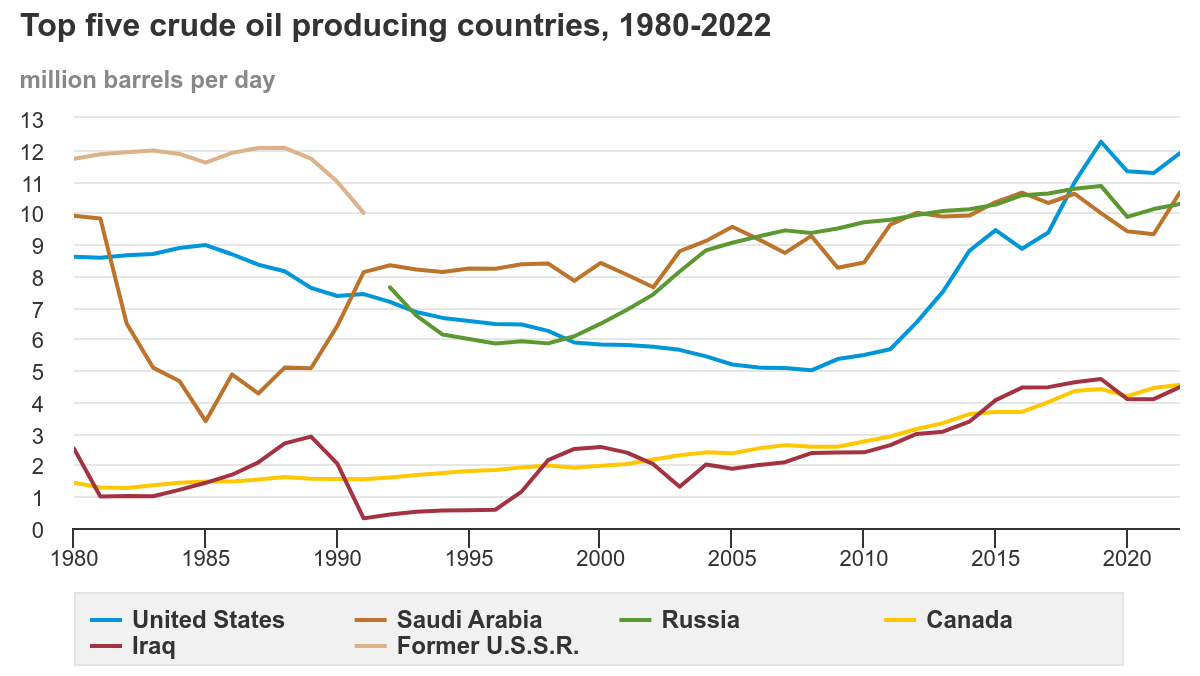

So, while it may sometimes seem like the House of Saud has a hold of one Western nipple, the U.S. is in the driver's seat holding two Islamic nipples and a handful of delicate hairs, sculpting the KSA's security situation while (at least temporarily) maintaining oil production parity with KSA and Russia. How else can we explain Saudi moves to normalize relations with Israel over the past few years (though the Israel-Palestine conflict may be a monkey wrench in that move).

From Morningstar,

Stories about the collapse of a longstanding 'petrodollar' agreement between the U.S. and Saudi Arabia spread like wildfire on social media. But the agreement never existed.

It seemed like big news, and many wondered why the mainstream media had seemingly ignored it. Turns out, there was a very good reason.

Earlier this week, reports circulating widely on social-media platforms like X offered up a shocking proclamation: A 50-year-old agreement between the U.S. and Saudi Arabia requiring that the latter price its crude-oil exports in U.S. dollars had expired on Sunday.

The collapse of the accord would inevitably deal a fatal blow to the U.S. dollar's status as the de facto global reserve currency, various commentators on X opined. Surely, financial upheaval lay ahead.

Almost immediately, Google searches for the term "petrodollar" spiked to the highest level on record dating back to 2004, according to Google Trends data.

But as speculation about an imminent end to the U.S. dollar's global dominance intensified, several Wall Street and foreign-policy experts emerged to point out a fatal flaw in this logic: The agreement itself never existed.

At least, not in the way it was being described in the posts that had gone viral on social media.

Does This Mean the Dollar is Okay?

My prediction (but I could be wrong): The dollar is "melting up" as fiat currencies (most of which are weaker U.S. dollar proxies) are losing strength all over the world. We may even see dollarization of foreign national economies over the next few years. Will that be the story in Argentina?

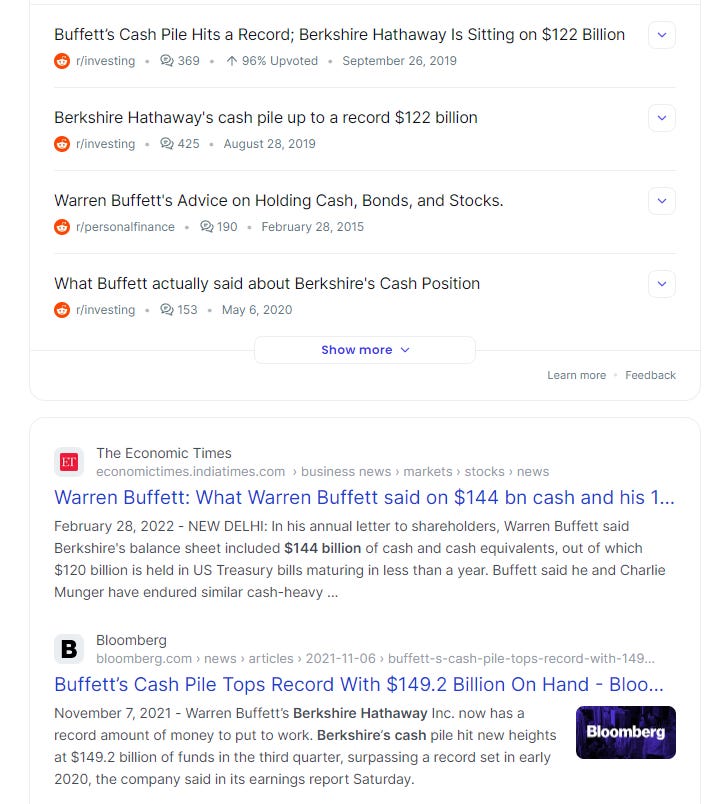

I have long believed that I would live through the end of the current dollar era, though I am less certain that I used to be. What I do think is the case is that fiat currencies are weak money that encourage terrible national monetary policy, and the global fiat currency regime will eventually die. But the dollar may be the last such currency standing. Perhaps this is why Warren Buffett has held between $100B and $150B of cash on the sidelines dating back several years before the declared pandemic?

Maybe he's planning to build [something] back better…

This is where an already complicated story gets more complicated. I'll try to make it simple without making it "overly simple" to the point of being wrong or misleading. But suffice it to say that I do not believe that dollar collapse is on the short horizon.

The dollar has problems. Massive federal government debt now measured in units of "dollars stacked to the moon and back" is somebody's problem. Russia dumped treasury bonds (as good as dollars) largely in 2018, and China continues to dump portions of their U.S. dollar bond positions as they did again last week.

How much does that even matter?

Say what you will about the Federal Reserve, the Western banking network has pulled more rabbits out of hats than most any of us who ever worked in finance ever expected possible. And at this point, I'm not even certain that Bitcoin isn't their next trick—or the one just after their next trick, or the one after that?

At this point, I'm going to be borrowing a lot of graphs from the intelligent Dr. Gerry Brady. If I do not credit a graph, it came from Gerry, and you'll usually know from the similarly-drawn trends. Gerry, whom I'm acquainted with, writes Boom Finance and Economics, which I read when I'm paying more attention to economics. Gerry and I agree more often than not, but some of my commentary will build on his, and some of it will depart from his. In particular, I do not think that Gerry is as familiar with Bitcoin markets as he is with traditional markets. Almost nobody is an expert in the whole of finance—and I'm perfectly happy to apply that to myself as well, which is why I read other people.

There are some scary graphs peddled in articles that might make one wonder if the global economy is breaking down.

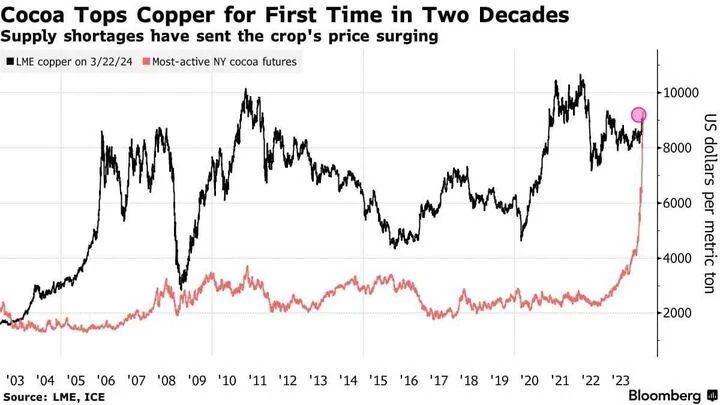

I predicted this spike late last year and spent over $100 (two purchases) on cocoa to ensure that brownie baking could still take place in my home for a while. I urged friends to stock up as well. No, I'm not kidding.

But my worry was not about whether the global supply lines would break down immediately, and somehow specifically affect the chocolate industry first. No. The issue is that the rapidly changing global financial situation puts more pressure on U.S. allies/frenemies/whatever than it does on the U.S. The best cocoa comes from those Central-West African nations that we sometimes call "French Neo-colonies" in addition to their official names. While France will likely survive this trying time as a nation, their leverage is taking a huge hit, so their grips on some foreign markets have loosened.

In Africa, the U.S., China, and Russia are struggling with one another to pick up what France drops. I stopped watching network news years ago, but my general assumption is that this story is not well-covered. It's probably too hard to craft a bullshit narrative over the truth of the story—much like the statistically abnormal number of deaths among African political leaders in 2020 and 2021.

But most of all, the competition for Africa is pushing France (and thus NATO) closer to war with Russia—assuming that Russia is not just playing a role in the whole global circus, which I refuse to grant as an assumption.

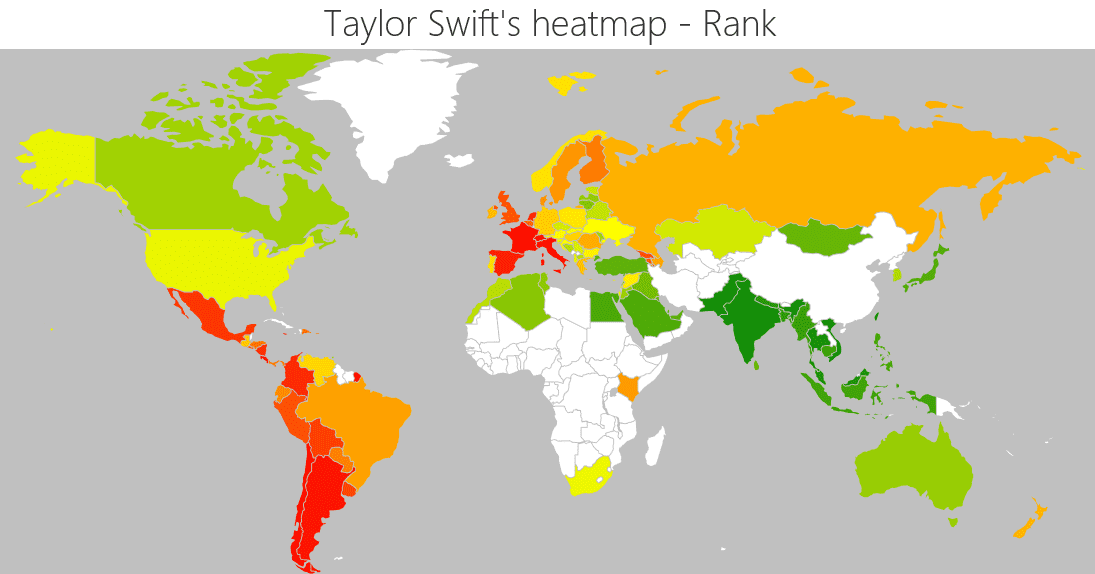

How does the NATO branch of the Anglo-American Empire prepare for war? Focus Americans on Ukraine, Asians on Taylor Swift, and threaten the chocolate supply of sex-starved Western women who are usually hard to get on board with risky global warfare.

Am I kidding?

That's not to say that I think war is inevitable, or that it would not be controlled in a way that allows for business as usual.

Metals important to technological infrastructure are not soaring in price the way cocoa is despite China's impossible-to-hide effort to stockpile massive quantities. While China might be preparing for war or possibly puppet-theater-war-for-profit, we would likely see greater volatility in the metals commodity markets if the Pentagon intended that route.

As Gerry notes, platinum has bobbed around a trading range for a while now:

Palladium got cheap:

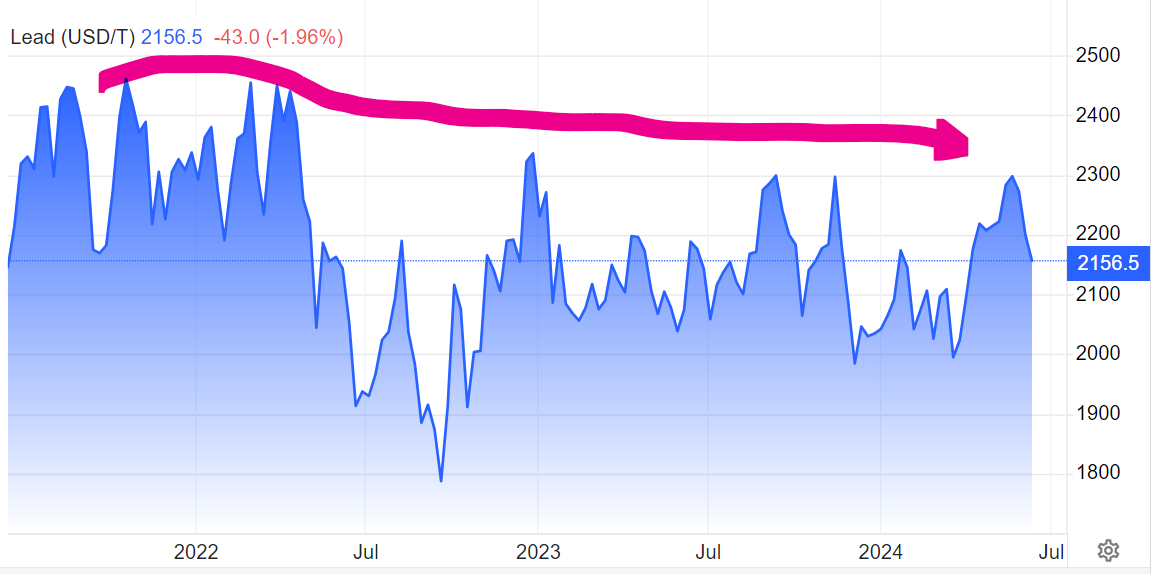

If there were some plan to fire off lots of bullets, we would not expect the price of lead to be stable—particularly as its use in electric vehicles has been ramped up:

Zinc? Tin? Same story.

Nickel saw an interesting spike in 2022…

But this was the result of sharks applying a short-squeeze to a position held by a Chinese nickel-maker at the outset of Russia's invasion of Ukraine (Russia supplies nickel). The West still knows how to weaponize finance better than all comers, and not by a little. More to the point, a certainty of large scale global war likely would have brought more sharks into the pool area for some of these important metals.

Whatever the war is, it is being fought locally, and often where the newspapers aren't going to talk about it. Otherwise, it's being fought at the level of finance. And yet, the global markets operate like a clock. Tick tock. Tick tock.

What Role is Bitcoin Playing?

Again, there is too much for a single article. But I'm going to focus on where I disagree with Gerry this time. Gerry,

BITCOIN — The Digital Commodity — looks like a Top may be forming? Or just consolidation? Very similar to Gold, Silver and Uranium over the last 3 months. Is the speculative frenzy over in these four “precious” speculative commodities?

Gerry then posts a chart for the Grayscale Bitcoin Trust, which has been a popular way for dinosaur investors to gain exposure to Bitcoin without having to learn how to use a cryptographic key.

The problem for chartists with Bitcoin is that a three-year chart, sans lognormalization, can tell the recent story of a traditional commodity better than for a new technology that looks like the early stages of getting a kite to fly, as the wind whips it around. The exponential growth dominates the scale, as we see in this Bitcoin price chart:

When we lognormalize (take out exponentiation of growth), the chart tells a much simpler story:

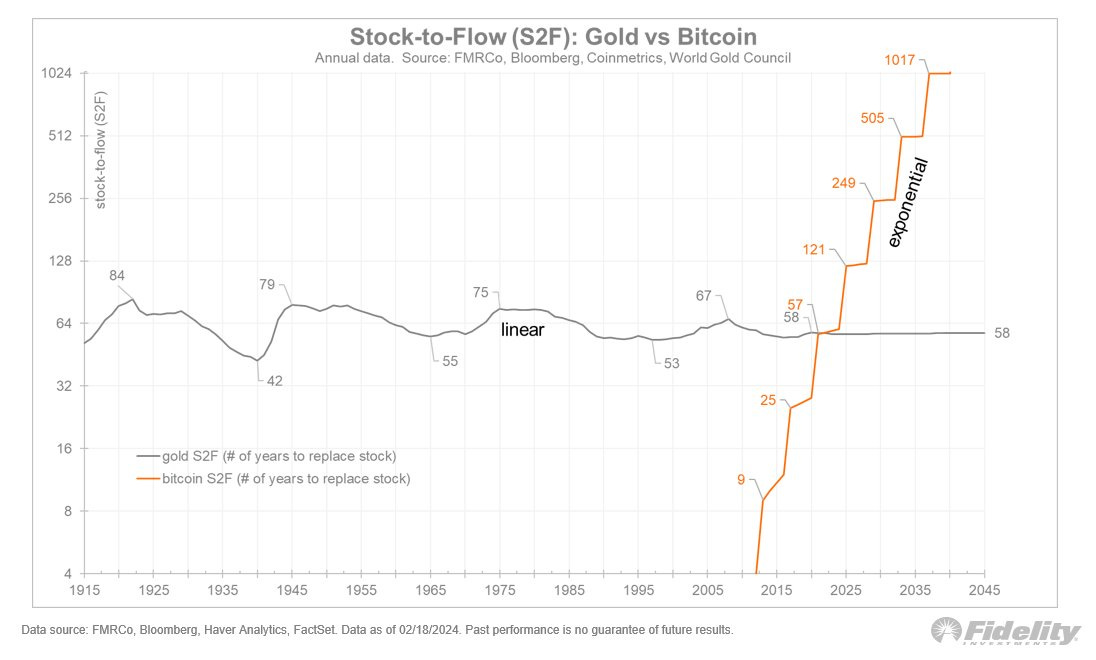

But if we really want to dig into Bitcoin price action, we find that there is a [nearly] four year (210,000 blocks in "Bitcoin time") cycle associated with price peaks that occur after block mining reward halving (which took place this April, indicating a bull run to come). The price bounces between mining costs and stock-to-flow ratio boundaries, as one [technical expert] would expect of a mined commodity. Only Bitcoin's defined block mining reward model is not nearly as mature as the mining conditions of traditional metals. Thus, we should expect for the price of Bitcoin not to follow the prices of gold and silver—even if there are some shared short term correlations owed to all of these commodities as hedges for inflation and the volatility of hard money capital demand.

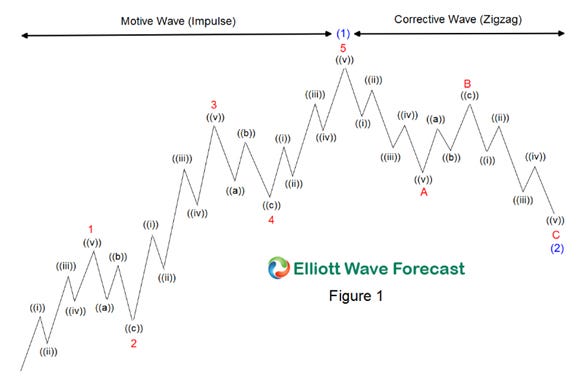

Further, the cryptocurrency trading world sees more defined Elliot Waves than other markets. I successfully applied this concept to my trading even though I'd previously thought of it as "technical analysis voodoo that isn't significant enough to pay attention to in regular markets."

Elliot waves are ostensibly produced as information spreads out among investor networks. However, I feel certain that they are induced in a lot of cryptocurrency markets—often by bots manipulating markets in shitcoins, but there do seem to be three waves of uptick in Bitcoin each cycle (though last cycle there were only two, owed most to the Chinese ban on miners taking place before the third wave, which may have been a national attack on the FTX scheme!).

The fact that we are one wave into the current bull market cycle is part of what I predicted that the 2024 POTUS election would be "The Bitcoin Presidential Election". Now two POTUS candidates have publicly supported Bitcoin. This will give them advantages in raising money and picking up support from increasingly Bitcoiners and economic dissidents during the election cycle.

The Propagandists Want You Freaked Out Scared

That's how Mindwar works, in part. Your biases get played upon. When you are frightened, you spend more money. You also donate to proxies who promise to fight for your cause, whether or not they intend to do so effectively.

Whatever your views about something important in the world—even if they are mostly correct in the long run—become tools of confirmation bias, leveraged by emotional manipulators who at some point realized that siloed media (including the new "alt" media) created great echo chambers that can be filled with noisy bots—and humans who are barely better than bots—to strengthen the echo chamber effect. I realized this after falling for it a couple of times myself. Most everyone has. It's one of the reasons I felt compelled to write about all the propagandists taking up oxygen in the Medical Freedom Movement.

I'm not saying that there isn't a lot to be concerned about and take seriously in the world and in financial markets. There certainly is! The consolidations of power over the past few years alone would warrant concern. But the odds are that the U.S. has been preparing for all this chaos for a very long time, so a transition to a new economic regime seems far more likely than global markets breaking down on a grand scale. Such a transition is likely to hurt people outside of the U.S. more than it hurts people inside of the U.S., no matter how much our Constitution continues to be gamed and eroded.

Thanks for putting this together I feel better now

The federal government spending money like a crackhead Hunter Biden weakens the U.S. and adds $3 trillion to the deficit annually. The insane steal of Russian assets by the US will severely compromise the U.S.'s status as a safe haven for capital. The EU is all in on that and it will destroy what little credibility they have. The EU wants war with Russia as it will give them the cause to invalidate their sovereign debt. They want the US to participate in that despite the US having no cause to back Ukraine other than to launder money, support the Biden crime family, run weapon biolabs and do whatever they are doing in the CIA stations. Putin just told them that now is the time to make a peace deal as it will be the best one they get. The EU is in favor of more dead Ukrainians as is Lindsey Graham.