Is Bitcoin Climbing the S-curve of Adoption?

What we kinda think we know about Bitcoin adoption through February, 2021

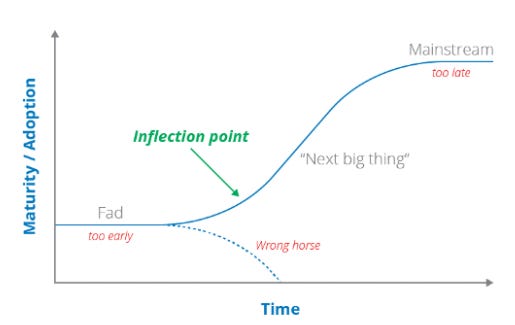

We identify birds by their feathered wings. We tend to identify the most world-changing technologies by S-curve adoption. Why? Perhaps because it takes time for an understanding of a new technology to propagate, resulting in an early period that begins like an exponential function, rising slowly at first before entering into a fast-growth period in which recipients of the new understanding overlap heavily with the media/teachers, then flattens just as quickly in a period in which the "laggards" are brought on board out of necessity or easier affordability brought by mass scale. Or voodoo. I strongly suspect voodoo.

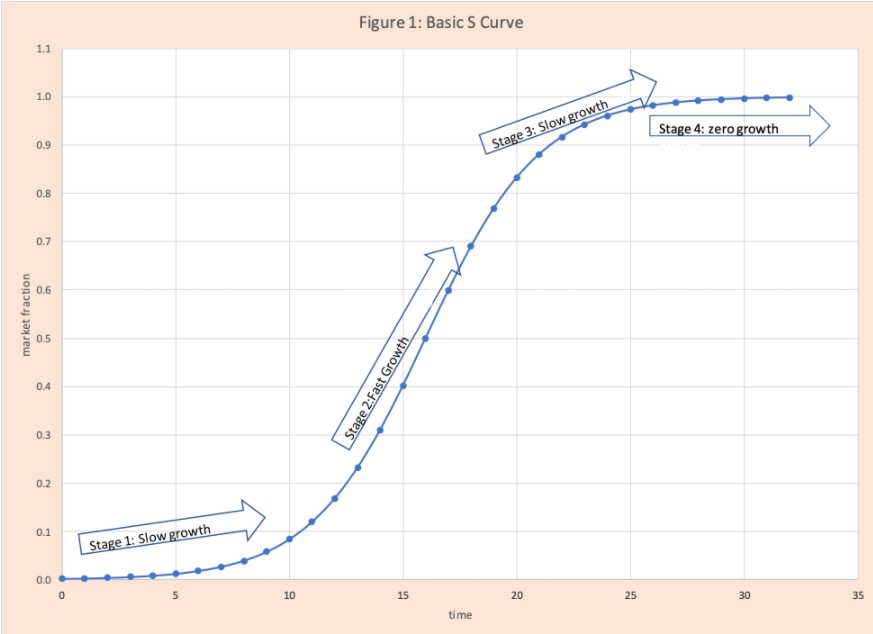

The basic math behind an (idealized) "ordinary" S-curve and a pretty picture:

Homework problem: Why do you think they call it an S-curve?

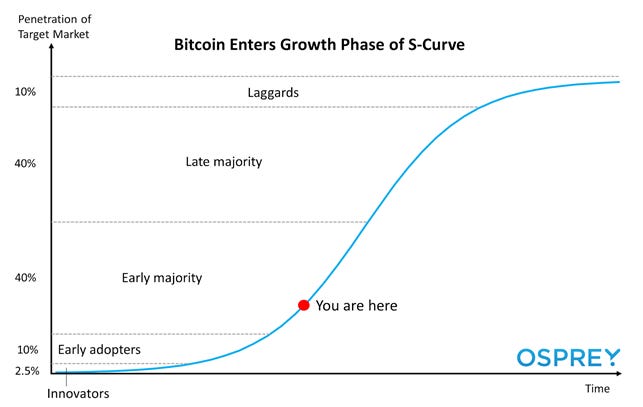

Here is another pretty picture with handy labels for "innovators", "early adopters", and people without foresight or money or something. It also includes a handy pointer suggesting we are at around 20% adoption, but without explanation for what population we're talking about, much less how that 20% figure was arrived at. This certainly doesn't represent world adoption because there aren't that many people holding money in banks at the present. I would assume it's made up, but I simply cannot imagine that people make up numbers and publish them on the internet.

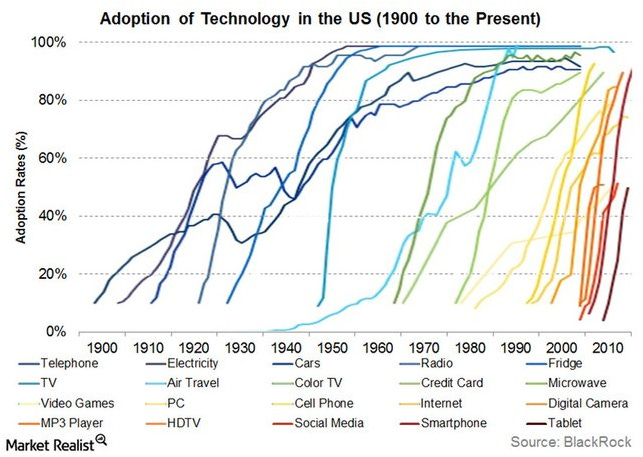

In practice, these kinds of adoption curves never look this nice, but they do sorta bear resemblance to an S-curve model.

Several things jump out at us about this graph:

Nobody at all thinks that pop music is a technology. But can you name an era in which four chords were used in combination with so many tempos and time signatures, and in so many permutations to better parent the youth? I thought not.

Yeah, okay, these are mostly somewhat S-curvey.

Adoption rates of new technologies seem to be speeding up on average.

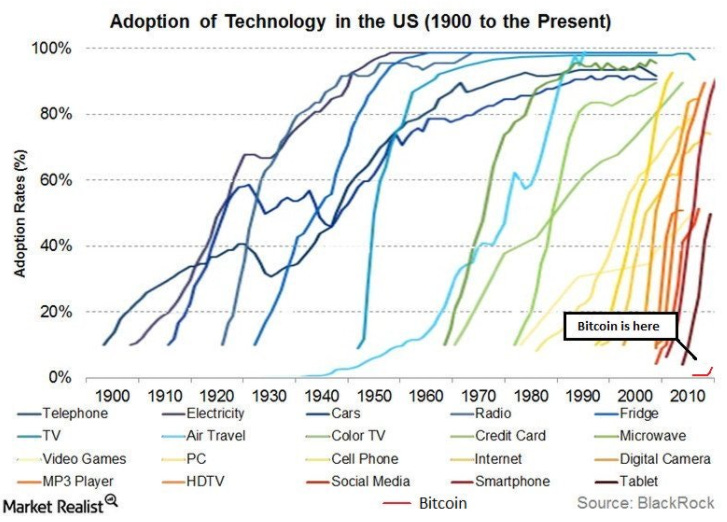

Let's see where Dave the Wave thinks we are on the Bitcoin S-curve:

Wait, is this based on actual data? I don't see any data. Is that like 3%? By what metric are we measuring adoption? If Bitcoin is private, can we find a reasonable estimation tool for the number of Bitcoin users? Does it matter if we're talking local (U.S.) or global? If this is global, is there some expectation that we'll manage to onboard nearly every last person in Africa in the blink of an eye?

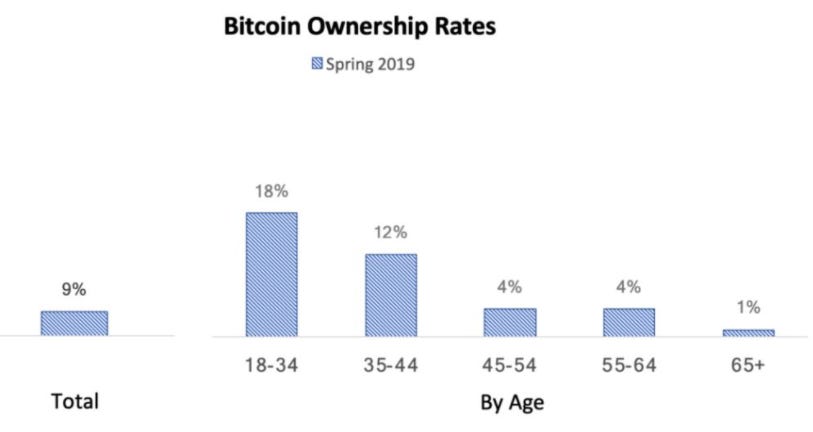

According to bitcoinmarketjournal.com, an estimated 11% of Americans currently hold Bitcoin. This estimate is based on a survey and so is biased toward people who answer surveys [no citation]. That survey was from 2019 (even though the article was written in November of 2020) and shows a paucity of Bitcoin owners in the 65 and older age group. However, since a bunch of those people died during the pandemic of 2020 due to a rather deliberate lack of attention to the value of early treatment medication, we can adjust that number upward. (I guess that joke is the only treatment of the topic that was anywhere close to "too soon".)

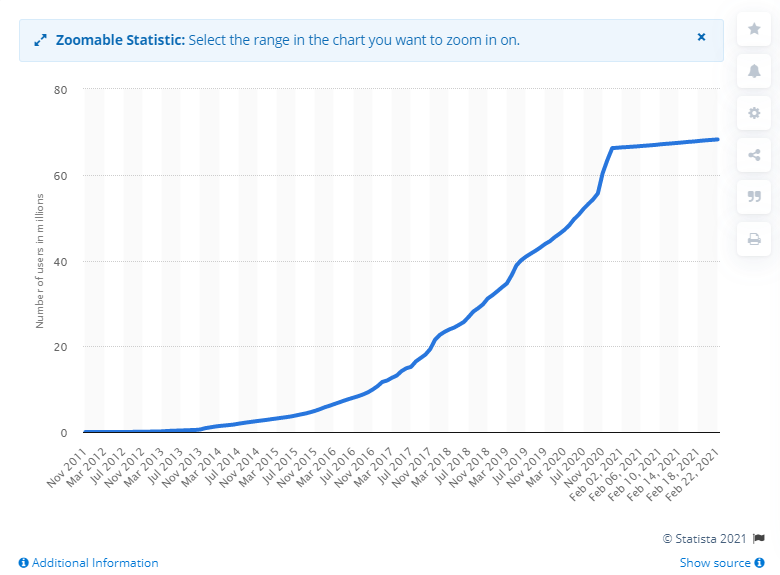

Now, in our quest to understand Bitcoin's possibly-S-curvey...cumulative adoption function (it's not an adoption rate, gah), perhaps we can at least analyze the growth in the number of blockchain wallets worldwide, as reported by statista.com (in order to understand the rate at which users are adopting Bitcoin). Actually, the people at statista.com call this a graph of wallet users, but how could they possibly know how many wallets each user has on average?! I have a bunch and I'm not telling anyone how many because I don't even know that off the top of my head and wouldn't tell you even if I did.

Um...something seems off here. Ah, right: it's the scale where the date(x)-axis jumps from three reporting points per year to once every four days. If you take a look at the actual numbers on the graph, wallet growth increased steadily from mid-2017 to mid-2020 at a rate of a little more than 30,000 per day. But in February, 2021, wallet users (or maybe just wallets because...we don't know) growing at a rate of nearly 100,000 per day. This represents a quick tripling in the Bitcoin (or Bitcoin wallet) adoption rate. And this faster new rate seems to be sustained since around the election. Exciting! Perhaps Bitcoin adoption really is bending up the bottom of the S-curve right at this very moment. Right in front of our eyes. And just beneath our feet. At the spot marked X on the map! And maybe in a notebook that we keep in that really really safe place that's kind of awkward to get to where nobody will ever find it.

But how far will it go?

There are some who forecast 90% penetration of Bitcoin into the U.S. market by 2030. I still don't know what that means (who really cares about definitions in statistics, anyhow? Are we all just data savages?!) and suspect there are not that many U.S. holders of long term wealth, but I could see that changing in time. Still, much as I love Bitcoin, this strikes me as optimistic. I could however envision 90% of U.S. wealth holders (outside of assisted living) storing Bitcoin by 2030 and 90% of Americans (outside of assisted living) using some form of cryptocurrency by that time, and perhaps all of that will be connected to the Bitcoin blockchain as sidechains. Then again, sometimes that Segway is too far ahead of its time to catch on and fails to climb the S-curve outside of the local police precinct.

So, after all of this "analysis", let us summarize our conclusions:

If Bitcoin is a technology, its adoption is probably growing according to some S-curvey-like shape.

Since Bitcoin seems to be accelerating in adoption growth, much like the bottom bend of an S-like-curve, it hasn't yet failed as a technology...and might be beginning the climb up the steep part of the S-ish-curve.

Lots of people on the internet make pretty curves with unsourced data or make hand wavy estimations when what we really want to understand is the rate of change and also the rate of change of the rate of change (or even steps in a step function if there is something unique about the pace of change from one Bitcoin epoch to another, maybe). I might have just made this part up for the summary, but it's true.

Nobody considers pop music a technology.

If Bitcoin is a new technology, you're not too late to achieve excess profits on an investment in the Bitcoin network. Unless you're reading this in the year 2072, in which case I'm delighted to know that artificial intelligence hasn't wiped out the human race (or that you're an alien or a robot).

You subscribed to the right newsletter (unless you didn't because you don't know any better yet).

The S curve is a good tool to show growth of companies. Bitcoin is not a company. It has no earnings, and never will. It is impossible to value other than using the "greater fool theory." If usage for purchases go through the roof, how does that make it more valuable? Pure Ponzi. I would like to know how it isn't if you think it isn't. Thanks.

Once it has some sort of utility, which it does not now, it can start on the curve. Right now we only have a ponzi scheme. No one actually purchases anything. Miniscule amounts by groupies.