Bitcoin and Energy Optimization

The Bitcoin Wars Part XI

I hope to put together several articles about Bitcoin and energy optimization. This is a topic I'm passionate about, and I even spent much of 2019 working on a business plan that included aspects of the Layer1 group that Peter Thiel invested $50M into, and was competing for the same land and substation here in Texas. (Our plan was better as it included a piece that would have saved them from the retail energy layer debacle they found themselves in as part of their vertical integration.)

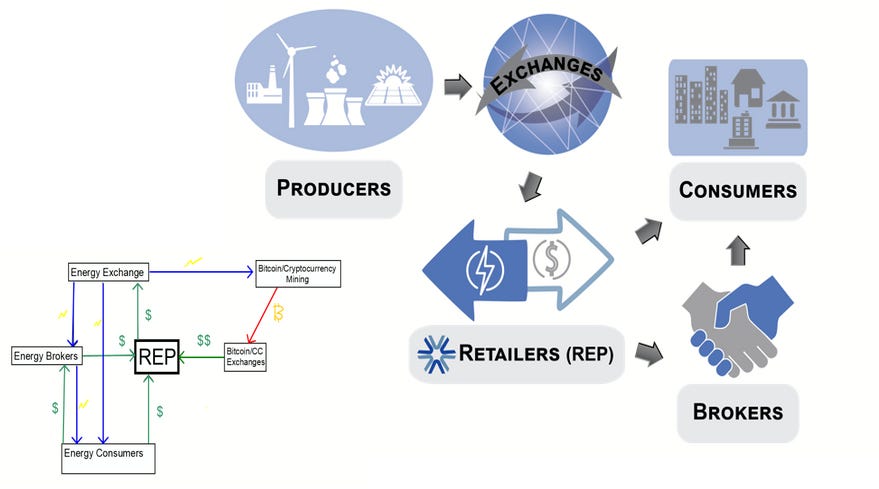

Vertical integration strategies are the key to the entire crypto space, and also the world's energy arena. This is a very basic graphic that doesn't give too much away on the business planning aspect, but will educate some readers new to thinking about the connection between cryptocurrency and energy.

The "REP" in these mashed together graphics I made is a "Retail Energy Provider", which typically operates in one of the 17 or 18 states with a deregulated electricity sector (18 including Nevada if they are fully online now, which will be great for electricity load balancing since Nevada is a good locale for solar production). The idea is that hundreds of billions of dollars worth of energy goes to waste each year, and for a variety of reasons. Decentralization allows for REPs to manage electricity finance and distribution, providing incentives for business and technological development strategies in a game theoretic race to the top.

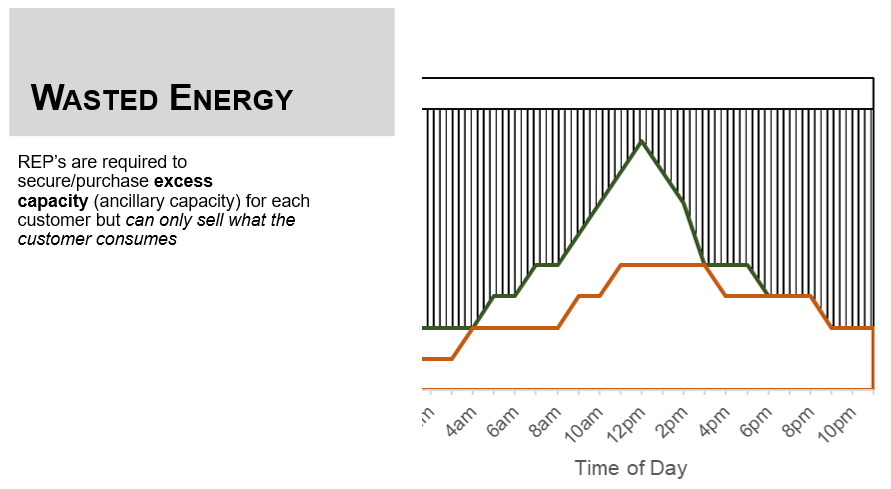

What happens in the system is that the REPs buy energy off exchanges where producers sell. Technically, they purchase energy capacity, and do most of that buying in bulk in flat distributions (all day and night). This purchase happens in a way that provides expected ancillary capacity at peak hours, which means dramatic ancillary capacity at off-peak hours.

The REPs might then try to woo as many night time energy customers as possible, selling energy at lower rates to nighttime establishments such as clubs and bars, or even manufacturers running machines overnight. We can call this a "load balancing strategy", but it's one of several. Another would be to include more solar energy production that would turn that flat capacity line into a hump that would sculpt supply and demand in such a way that less energy gets wasted. It's not just a win-win when this gets accomplished. It's a win-win-win-win-win!

Lower energy prices

More stable grid

Lower relative externalities (pollution)

Aligned incentives (huge positive externalities)

Flatten the curve (for realz)

Even a modest amount of battery storage capacity further reduces the amount of ancillary energy needed to run the system. That amount becomes more modest as more solar comes online. This further prevents the need for the costly starting/stopping of power plants as energy demand comes and goes.

Within such a model, I would also get to employ my trading talents, which is how I have made most of my income since leaving college. Any time the technologies of business planning open new slack in previously existing models, that opens the door to parlay the gains into further gains. This should be done strategically and carefully, but it's an opportunity. Those deploying capital well have the advantage in deploying more capital.

The Bitcoin/cryptocurrency industry is busy performing this optimization dance at scale, moving equipment around the world to optimize the process. Here is part of a mining farm I helped a buddy move a couple of years ago.

By moving mining equipment to locations that can make use of otherwise wasted energy, which is the cheapest to purchase or use, otherwise wasted energy is recaptured for productive use. This is one of the reasons why the "Bitcoin makes mass pollution" meme is fallacious. The people making that argument do not understand that (1) upwards of 60% of energy is lost in current systems (even "line loss" incurred while moving electricity over distance is massive)

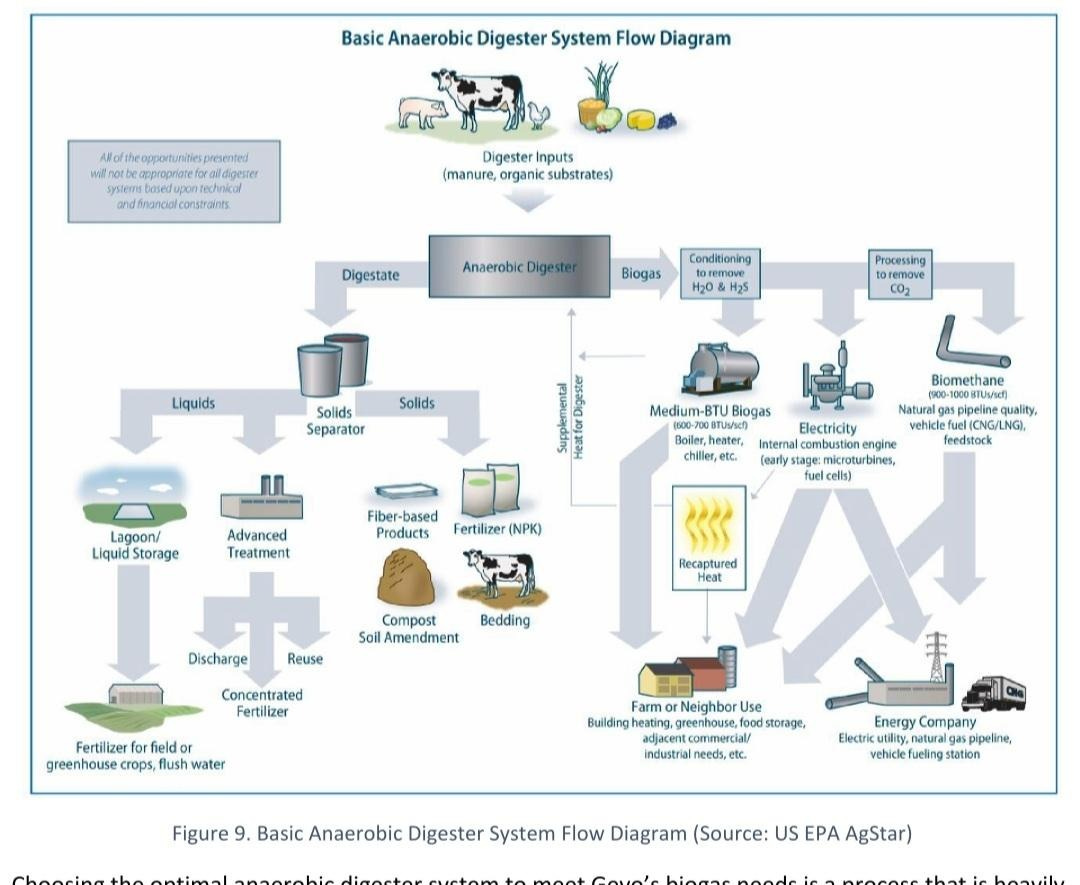

There are other ways energy gets saved, such as mining Bitcoin from otherwise wasted natural gas that gets flared off oil/gas drilling sites. And while much of the work is being performed privately, out of the public eye, there are massive efforts to vertically integrate even anaerobic energy into this new system.

A friend just shared with me this plan moving forward to add solar capacity and energy storage at airports, which includes the use of electricity in mining. This will provide substantial savings and new profits for the airline industry model, and some of that energy will then be available during crises such as the recent Texas super-freeze that threatened the energy grid of 10% of the entire nation.

As for the business plan (of my own) that I mentioned earlier, I'm keeping a certain ingredient close to the vest, but it provides further granularity to the process of decentralizing mining and reducing cost and waste in the electricity generation and transportation processes.

Banking is Mining is a Choice Between Energy and Debt Slavery

"If you don't believe it or don't get it, I don't have the time to try to convince you, sorry." -Satoshi Nakamoto

I have a little time today…

Once upon a time, money was metal (scarce, fungible, and difficult to fake commodities), and metal was mined. Then came the banking industry to manage the money, which is to say that banks were always about the finance of mining. Along the way, the bankers figured out that they could also mine people, generating misery as the direct externality (pollution is still downstream from that). They found ways to turn debt into money, setting people up for lifetimes of debt slavery (and propaganda machinery to keep people gas lighted and blamed for it).

Mine from energy, or

Mine from human misery.

Pick one.

Perhaps "slavery" is an overly dramatic way to put such an arrangement, except that it might be even more insidious than even voluntary servitude contracts of history because children grow up and into it, often quite manipulated and devoid of financial education. That means that the wealthy have an incentive to sabotage the educational system as a way of generating more debt slaves. This is how we end up with a runaway Prussian model, which then incentivizes society moving toward fascist authoritarianism.

Meanwhile, the actual energy and resource usage of the current system gets strangely discounted. It should be said that,

The banks are the currency are the military.

And together with the governments they purchase and puppeteer, they use the substantial majority of the world's energy and resources, with lots of waste along the way. Bitcoin mining means using those resources more efficiently, with better incentives for new energy production, better computing efficiency, and less cost of security. Oh, and the wars required to expand the global banking network. That's not trivial.

Wouldn't you rather live in a world in which local populations did not feel the necessity of investing so heavily in militaries whose first job is to protect and expand the network of the reserve currency? What would the world look like if we reinvested those resources in education and technological research and development? I'd like to find out!

That's where we are, folks. That's why this issue is so important. As we enter the Age of Electron, perhaps we should be working to account for the energy and externalities of the entire systems that would be replaced before worrying about the electricity used by a global Bitcoin network, which I fully expect to be far smaller. After all, that's the point of moving toward a decentralized system: putting incentives for local thrift in every corner of the system. One way or another, it all comes down to energy.

" Oh, and the wars required to expand the global banking network. That's not trivial."

That's no small thing--That's the whole thing.--Sara Groves

Is it possible to consistently trade bitcoin and not lose everything? Is it possible to trade any market and not lose everything without inside information or front-running or deep pockets or rigging the game via volume cross-ups (wash & rinse) or algorithmic scalping?

If so, what's the secret, other than buy low and sell high? Do the opposite of what the crowd is doing? Buy pull-backs? Linear regression channels? Value investing? Astrology?